“Inflation” is on everyone’s lips. Commentators and politicians are quick to point out the perpetrators. It is said that climate change is the cause of rising prices or that a specific war maker is to blame. A popular opinion holds that inflation is rising because the costs are rising—ignoring that costs are prices, too.

More informed people would probably point to the central bank as the guardians of price stability and lament their failure. While on the right track, even this explanation runs too short because central banks claim too much when they promise that they could keep price inflation in check and the economy on a stable path.

Monetary Price Inflation

Price inflation, understood as a persistent general rise in prices, has monetary causes. It occurs when overall monetary expenditures rise faster than output. Money expenditure higher than the change in production, and thus the supply of goods and services, makes goods more expensive. In other words, excess money creates a shortage of goods, and prices may rise even if production has not diminished.

Because the macroeconomic effect does not occur uniformly, the changes in monetary demand relative to the supply of goods have redistributive consequences. The Cantillon effect says that money does not enter the market smoothly and does not come into the hands of the market participants equally. Price inflation does not mean that prices rise a “level.” Monetary expansion does not drive up prices steadily and for all to the same degree.

A general increase in prices may also take place without an expansion of the money supply because of production cuts—for example, due to embargoes, wars, and natural disasters. Here, too, specific prices rise because the supply of certain goods has shrunk. Yet price inflation is also a monetary phenomenon because of the existence of a monetary overhang.

How does such a surplus of money expenditure come about? What causes this monetary overhang? Just as there is production of goods, there is production of money. At the core of money production is the creation of so-called base money by the central bank. Alongside the central bank, the commercial banking system also produces money by granting loans. Money creation takes place when the government, companies, and consumers obtain loans. The link from the original money creation by the central bank to its final impact on economic activity is called the transmission mechanism.

Through borrowing, the original supply of base money created by the central bank will multiply. An increase in the money supply allows more nominal demand for goods and services. The discrepancy between the supply of goods and nominal demand leads to price effects. In the long run, the money supply determines the general price level. Whether prices in general rise or fall depends on the relative change in money in circulation compared to the rate of change of the supply of goods.

It is mainly the monetary base that is under the control of the central bank. The other variables that determine the money supply and its impact on the national income are beyond the direct control of the central bank. Monetary policy can influence the banking multiplier somewhat by setting minimum reserve requirements, but over the voluntary and precautionary bank reserves the central bank has much less power. Even shorter is the central bank’s reach in determining the velocity of money circulation.

Velocity of Circulation

To understand inflation, several factors must be taken into account: how money enters the economy, starting with the central bank and the lending activities of commercial banks in response to credit demand by the government, businesses, and households. Another factor is the rate of change in the circulation of the money supply. This so-called velocity of circulation depends on the actions of economic agents. Transactions increase or decrease depending on how quickly people, firms, and government agencies spend their money. The more money moves from hand to hand, the higher the so-called money velocity. Therefore, the velocity of circulation must not be regarded as a purely statistical concept by dividing the nominal national income by the respective monetary aggregate. Velocity is a concept of human action.

An increase in money prices means a reduced purchasing power. Because human action takes place from moment to moment, from decision point to decision point, expectations change with the circumstances. If an individual expects rising prices for the goods he plans to purchase, he will increase the speed of his spending, and when falling prices are expected, his transaction frequency will tend to fall. This creates a self-reinforcing loop: existing price inflation tends to accelerate because people want to turn their money into goods as quickly as possible. In contrast, price deflation will deepen when people prefer to wait on spending because they expect that prices will fall further.

If prices continue to rise, the transaction speed increases, and the inflation feeds itself. Similarly, the expectation of price decreases encourages hoarding.

The money supply is counted as M1 because the means of payment consist of cash in circulation and the deposits of private economic entities and the public sector. The M1 money supply is used to perform the transactions in the economy, and the use frequency of a unit of money—its velocity of circulation—varies over time according to the actions of the economic agents.

As can be seen in figure 1, money velocity, which represents the ratio between the national income and the monetary aggregate (in the present case, M1), is subject to vast swings.

Figure 1: Money Velocity (M1), 1959–2022

mueller_graph_1_third_article.png

Source: FRED.

Figure 1 shows a stable upward trend for almost three decades, until 1981, which was the turning point toward a highly volatile downtrend in M1 velocity. In 1994, the trend twisted again, and after M1 velocity peaked in 2008, it fell drastically and started free falling in early 2020.

The variables in the monetary transmission process, and especially the velocity of circulation, may reinforce the monetary impulse or counteract it and make monetary policy impotent. In view of the vagueness of the quantitative relations, the central bank cannot reliably calibrate its policy. Monetary policy errors are not the exception but the rule.

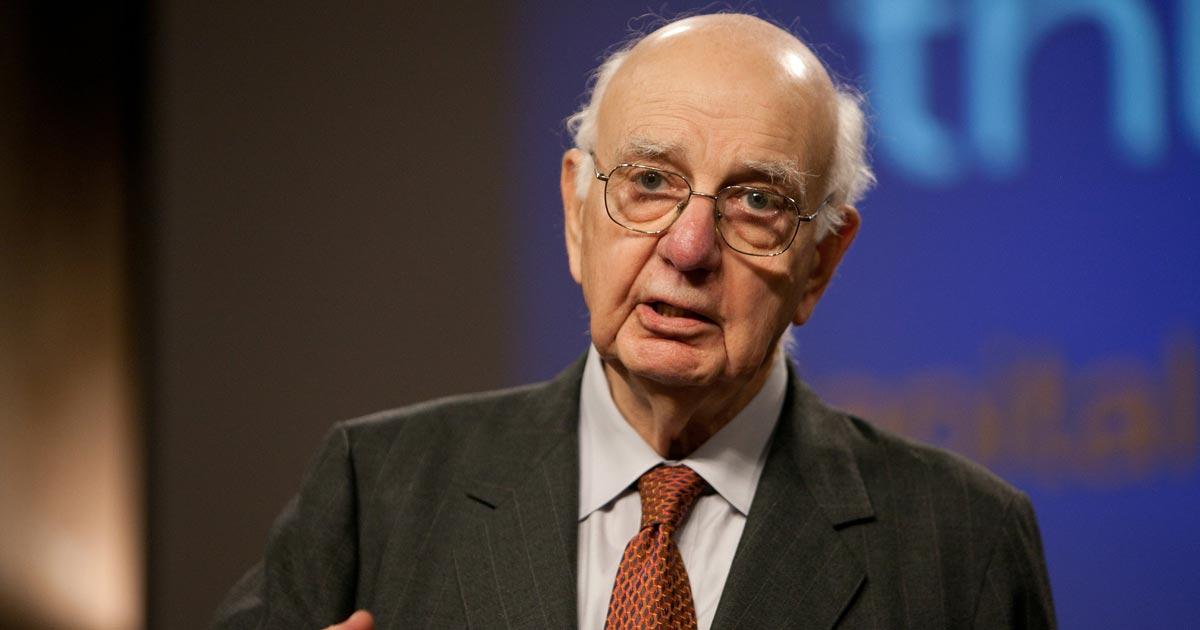

The monetary policy failures of the second half of the 1990s, the crisis of 2008, and the recent monetary turmoil are well known. Less known is what happened in 1979, after Paul Volcker was appointed chairman of the Federal Reserve System on August 6, 1979, to serve until August 11, 1987. It was the declared intention of the chairman to bring price inflation under control, which was approaching an annual rate of 15 percent by December 1979. Calibrating the reduction of the money supply required an assessment of the money velocity. The Fed staff was confident that the money velocity’s trend would continue as it had been for the past decades.

As told by William A. Niskanen and Paul Volcker himself, the assumption of a continued upward trend in the velocity led the monetary authorities to commit the grave policy error of reducing the money supply much more than what their intentions justified. The Fed did not want to bring the inflation rate down as rapidly as it fell in the early 1980s, when it came close to 2 percent in a short time. An unintended consequence of this miscalculation was that public expenditures under the Reagan administration took off. Intended moderate increases in expenditures in real terms turned into massive budget deficits because contrary to expectations, price inflation had almost vanished.

The incalculable volatility and trend direction of the velocity of circulation also helps explain why the US Federal Reserve’s expansionary monetary policy since 2008 did not trigger price inflation for quite some time. The drastic fall in the velocity ratio counteracted the expansion of the money supply. The additional money created by the policy of “quantitative easing” did not turn into a great increase in nominal demand because the velocity of circulation fell from over ten to almost zero (see figure 1).

A new chapter opened toward the end of 2021. The free fall of the velocity ratio has stopped. At the same time, price inflation took off and accelerated in early 2022. A reversal of the velocity trend imminent. Even more extreme price rises will follow when inflationary expectations take hold. In this case, the velocity of circulation will shoot up, and the Fed will be able to do nothing to stop it.

Conclusion

The chain of monetary transmission between the expansion and contraction of the monetary base and its effect on national income and production structure is long and variable. The variables fluctuate erratically and are subject to abrupt turns. The monetary policy makers cannot reliably calibrate the consequences of their interventions because the variables of monetary transmission may counteract or reinforce the original monetary impulse. From this it follows that the more discretionary and interventionist the central bank is, the higher the risk of committing gross mistakes becomes.