When the Bourbon dynasty was restored to power in France in the early 1800s after Napoleon’s abdication, the French statesman Charles-Maurice de Talleyrand famously said of that family: “They had learned nothing and forgotten nothing.” In modern economic parlance, one can say the same thing about progressives, who once again are demanding price controls to “fight inflation.”

Not surprisingly, Sen. Elizabeth Warren is leading the way. She recently introduced a bill that outlaws “price gouging,” which in her definition involves a seller increasing prices for reasons that Warren would consider to be unjustified. It declares:

It shall be unlawful for a person to sell or offer for sale a good or service at an unconscionably excessive price during an exceptional market shock, regardless of the person’s position in a supply chain or distribution network.

While at least Warren is not calling (yet) for criminal penalties, she would empower the Federal Trade Commission to investigate such price gouging and to levy fines of either $25,000 or 5 percent of revenues, whichever is higher. That there is no way, economically speaking, to coherently define something like price gouging is no deterrence to Warren, who for many years has tried to move to the left of Bernie Sanders on nearly all issues.

But Warren is not the only progressive to call for price controls. Harold Meyerson, the socialist who also is an editor for the American Prospect, is demanding price controls, declaring that levying them will help keep Democrats in power. He writes:

As if inflation on that scale weren’t bad enough, its electoral consequences are likely to shift control of Congress to racist, insurrectionist, conspiracy-addled nitwits in November’s elections.

How, then, can the Democrats forestall or at least mitigate this grim double whammy? Joe Biden appears to grasp the peril he’s in; it’s compelling him to make a pilgrimage to Saudi Arabia and its murderous crown prince in the hope that the prince will bring more of his nation’s oil to market, thereby driving down prices.

But there’s a less morally bankrupt, economically more effective, and far quicker way of achieving the same ends. It’s called price controls.

Before anyone rolls the eyes and reminds this socialist sage that price controls have a long history of failure, Meyerson has a ready answer:

Contrary to what economic orthodoxy would have us believe, such controls have been markedly successful at various times in our nation’s history. (Economic orthodoxy is often clueless about history in its preference for theory over fact.) According to Hugh Rockoff, a professor of economic history at Rutgers, price and wage controls brought the yearly rate of inflation down from 32.4 percent to 7.1 percent during World War I, and from 11.9 percent to 1.6 percent during World War II. Of course, as Jason Zweig pointed out in a recent Wall Street Journal column, people are more likely to accept such controls during wartime than they are during peacetime. Then again, having not really experienced a run of inflation for the past 40 years, Americans are rapidly going into shock as food and fuel prices continue to run amok. Selective controls on key commodities might not only provide the only way to achieve some fast relief, but also demonstrate, in tandem with legislation to cut the price of prescription drugs and the cost of child care, that the Democrats can actually and effectively legislate and implement policies in the public good.

One is not sure how sound economic theory such as the laws of demand, supply, marginal utility, and diminishing marginal returns really are nothing more than social constructs that easily are undone by “facts,” but one has to remember that socialists have their own rewritten history. Furthermore, like most progressives (and socialists), Meyerson assumes that the only things that will change under a price control regime are the prices themselves, with no accompanying shortages and other dislocations. But what about the “markedly successful” price controls of which he writes?

Not surprisingly, Meyerson turns to the experiences of the USA during two world wars as the example of success. While he does not define what “success” meant in those situations, he implies that price controls kept the official rate of inflation lower than it would have been without the controls.

Yet that tells us absolutely nothing, for he fails to mention the shortages, official rationing of goods, and the general economic misery that Americans faced during those conflicts, when the economy, geared to total war, vacuumed up vast numbers of resources, leaving Americans on the home front to scramble for the leftovers and, with much difficulty, scratch out a living. Economist Robert Higgs, who is well aware both of economic facts and theories, laid out a much different scene in his authoritative 1992 paper in the Journal of Economic History.

Entitled “Wartime Prosperity? A Reassessment of the U.S. Economy in the 1940s,” Higgs looks well beyond the official numbers that Meyerson gives to see how Americans really lived under price controls. Regarding the official inflation numbers, Higgs writes:

In fact, conditions were much worse than the data suggest for consumers during the war. Even if the price index corrections considered above are sufficient, which is doubtful, one must recognize that consumers had to contend with other extraordinary welfare-diminishing changes during the war. To get the available goods, millions of people had to move, many of them long distances, to centers of war production. (Of course, costly movements to areas of greater opportunity always occur; but the rate of migration during the war was exceptional because of the abrupt changes in the location of employment opportunities.) After bearing substantial costs of relocation, the migrants often found themselves crowded into poorer housing. Because of the disincentives created by rent controls, the housing got worse each ear, as landlords reduced or eliminated maintenance and repairs. Transportation, even commuting to work, became difficult for many workers. No new cars were being produced; used cars were hard to come by because of rationing and were sold on the black market at elevated prices; gasoline and tires were rationed; public transportation was crowded and inconvenient for many, as well as frequently pre-empted by the military authorities. Shoppers bore substantial costs of searching for sellers willing to sell goods, including rationed goods, at controlled prices; they spent much valuable time arranging (illegal) trades of ration coupons or standing in queues. The government exhorted the public to “use it up, wear it out, make it do, or do without.” In thousands of ways, consumers lost their freedom of choice.

He adds:

People were also working harder, longer, more inconveniently, and at greater physical risk in order to get the available goods. The ratio of civilian employment to population (aged 14 and over) increased from 47.6 percent in 1940 to 57.9 percent in 1944, as many teenagers left school, women left their homes, and older people left retirement to work. The average work week in manufacturing, where most of the new jobs were, increased from 38.1 hours in 1940 to 45.2 hours in 1944; and the average work week increased in most other industries, too—in bituminous coal mining, it increased by more than 50 percent. Night shifts occupied a much larger proportion of the work force. The rate of disabling injuries per hour worked in manufacturing rose by more than 30 percent between 1940 and its wartime peak in 1943.

It is difficult to understand how working harder, longer, more inconveniently and dangerously in return for a diminished flow of consumer goods comports with the description that “economically speaking, Americans had never had it so good.”

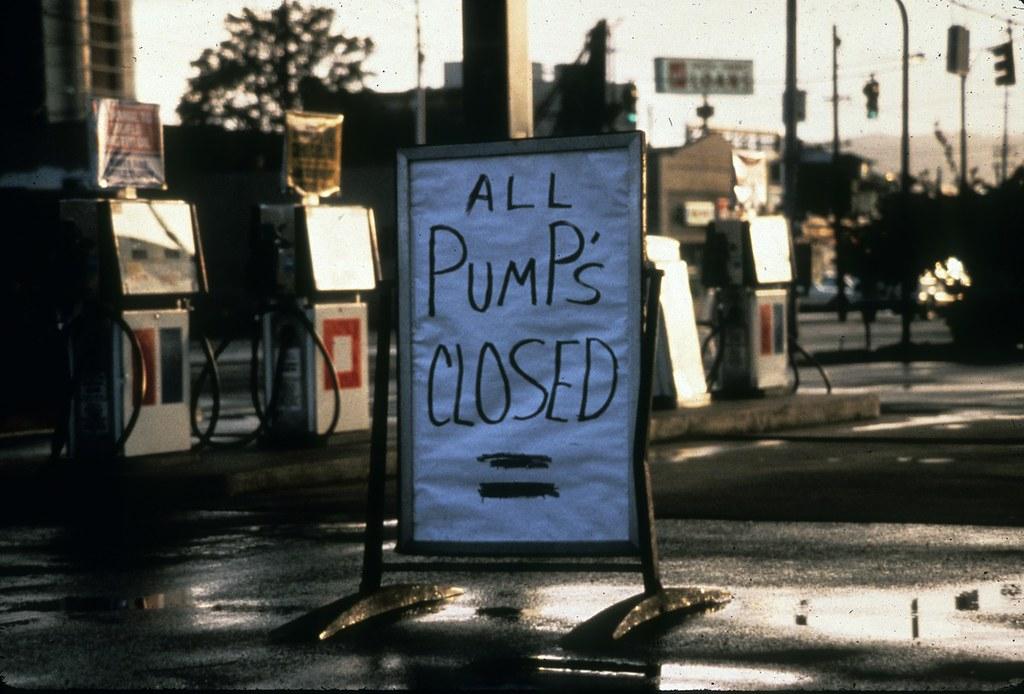

Likewise, Meyerson does not remind his readers of the energy price control regime of the 1970s, which led to huge fuel shortages, long lines at the gasoline pumps, and huge disruptions in production. Then, like now, the progressives that supported price controls blamed “corporate greed” and “big oil” for the problems, not wanting to admit that price and allocation controls created the havoc that seemed to disappear once the government lifted controls in 1981.

Declaring that price controls were “successful” is reminiscent of the US end game strategy in the Vietnam War: declare victory and leave, paying no attention to what is happening on the ground. Likewise, the progressives and their socialist allies demanding yet another price control regime want to drag the rest of the country into their world of economic make-believe.

There is no doubt that if Joe Biden were to slap down price controls (declaring an “economic emergency” or something similar), such a move would resonate with at least some of the voters. Moreover, when the inevitable shortages and long lines appear, he can denounce “corporate greed” and he and his cabinet can look indignant at their photo ops. One suspects that the New York Times, Washington Post, and CNN would gladly jump on the bandwagon.

But none of these optics can hide the true costs of price controls. Progressives might control the media and the government, but they cannot control reality. Contra Meyerson, facts and economic theory have a long history of fitting one another.