Last year, just as it was becoming increasingly clear that price inflation was mounting, Jerome Powell repeatedly denied there was any reason for concern. He called inflation “transitory.” A few months later, he admitted it was not transitory, but denied it was “entrenched.” Then, by late 2021, he admitted price inflation was getting out of control but still took no action of any consequence. Through it all, the Powell plan was repeated delay and opposition to any lessening of the Fed’s established policy of ramming down interest rates again and again.

By spring 2022, however, it became impossible to pretend the previous six months of rising inflation rates never happened. In order to avoid looking utterly clueless, Powell was forced to endorse a 25 basis point increase to the target rate in March. But that amounted only to a 0.50 percent target rate. Then there was a 50 basis point increase in May, so the target rate rose to a meager 1 percent. After June’s meeting, the target rate sat at 1.75 percent— a small fraction of the target rates we saw even during the years of monetary inflation and housing bubbles under Alan Greenspan.

The other side of this ultraeasy monetary policy is quantitative easing via the Fed’s asset purchases of mortgage-based securities and government debt. These purchases were made with newly created money. Although Powell talked a big game about scaling back quantitative easing and reducing asset purchases, actual action was virtually nonexistent, and the Fed continued to print money for more asset purchases into March 2022. Since Powell finally announced the end of QE, the Fed’s assets have decreased by a paltry 0.3 percent.

In other words, Powell’s Fed is a Fed that does no more than is absolutely necessary to convince the public and policy makers that it is “doing something” about inflation. This is all short-term political posturing, and reflects that fact Powell—like Janet Yellen before him—is a politically minded technocrat who thinks in terms of using the central bank to protect the regime. The regime needs to look like it is “managing” the economy. But the regime also needs low interest rates to keep down interest payments on its massive $30 trillion debt. Powell is apparently more than happy to oblige on all fronts.

When it comes to actually doing something to address the core causes of price inflation, however, Powell seems uninterested. The plan right now is apparently to trust in hope that inflation can be “fixed” with some very minor tinkering with the federal funds rate and the Fed’s portfolio. And then everything will be fine.

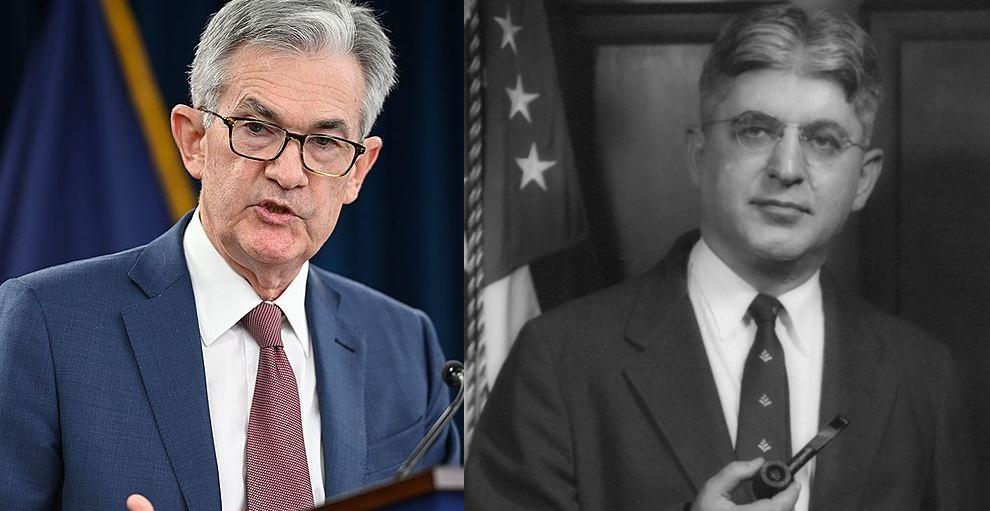

This mirrors the thinking of Arthur Burns and his Fed during the 1970s. While inflation mounted in the late 1960s and early 1970s, Burns—who became chairman in 1970—chose to avoid doing anything that might upset the inflation-fueled economy that had prevailed during the previous decade. The result was 12 percent inflation by the mid 1970s and an inflationary period that only came to an end after Chairman Paul Volcker finally had to take the anti-inflationary measures that Burns was unwilling to take.

With his current timid, weak, and prevaricating position on price inflation, Powell is positioning himself as the new Arthur Burns. He’s only interested in doing just enough to get inflation rates down far enough to deflect political pressure from taxpayers, consumers, and others who suffer most from price inflation. It’s nothing more than kicking the can down the road. That is Burns’s legacy, and Powell is embracing it.

Arthur Burns and the 1970s

Fueled in part by big spending on the Vietnam War and on Lyndon Johnson’s new welfare programs, Consumer Price Index inflation rose from 2 percent in the mid-1960s to 6.4 percent by February 1970. At that point, inflation was at the highest rate it had been since the Korean War. Burns, however, was not exactly one for bold action. Outgoing Fed chairman William McChesney Martin had already attempted to rein in inflation with a rising discount rate in 1968 and 1969. (The discount rate was the key policy rate at the time.) As a result, the discount rate hit 6 percent and a recession ensued. Burns was only too happy to bring rates back down as the 1969–70 recession subsided. Thanks to the short recession—and to the usual disinflationary factors such as growth in worker productivity—price inflation temporarily and moderately declined for the next two years. But by 1973, price inflation was surging again, and inflation hit 12 percent in November 1974. At the worst of it, the Fed raised the discount rate from 5 percent in 1973 to 8 percent in 1974. That looked like it “did the trick” because price inflation then fell back down to 5 percent by December 1976. But then price inflation soon began an upward surge that would not end until 1980. The CPI inflation rate rose from 5 percent in December 1976 to 8.9 percent two years later. It finally peaked in 1980 at 14.4 percent.

In other words, Burns’s methods did not bring inflation under control for anything more than the short term. Nor did Burns’s policies bring robust growth, as the country endured another recession from 1973 to 1975, and again in 1980. Stagflation set in. Meanwhile, the Burns Fed, much like the Powell Fed, sought to portray price inflation as a temporary matter related to short-term shocks. As noted by Ricardo Reis:

[Burns] thought the inflation of 1973 was due to food and oil prices, and the further increase in 1974 was due again to budget deficits (even though those had been small). There was always a temporary shock to explain the persistent drift. Meltzer (2005, 160) describes this period as one when, among the Federal Reserve staff, “they gave special explanations—a relative price theory of the general price level—in effect claiming that the rise in the price level resulted from one-time, transitory changes that they did not expect to repeat.”1

Arthur Burns would have been right at home in the Powell Fed, where inflation is to be blamed on temporary one-time events such as logistical supply shocks and the Russian invasion of Ukraine.

After Burns, 20 Percent Interest Rates

It was only after Paul Volcker was installed as the new Fed chairman in August 1979 that the Fed would take the drastic action that was needed.

In 1980, the Fed finally began to significantly depart from the policies of the previous decade. In February, the discount rate was raised to 13 percent, reflected in a federal funds rate that briefly reached 20 percent in late February. Not even that was enough. Inflation was still above 10 percent in mid-1981, and it was in November of that year that the Fed was finally leaving nothing to chance. From late 1980 to mid-1981, the discount rate hovered between 11 percent and 14 percent, while the federal funds rate rose to 20 percent in November 1980 and again in May 1981. Neither of these rates would not fall below 10 percent again until October 1982.2

By 1983, the inflation rate had fallen to 2.5 percent for the first time since 1967. By 1986, inflation had fallen to 1.2 percent.

The inflation cycle that had begun in the mid-1960s—”the Great Inflation”—was finally ended, although the regime certainly did not learn its lesson. The Reagan administration soon after embraced big spending and big deficits. The US committed to devaluing the dollar through the Plaza Accord in 1985. The Greenspan era began in 1987 with the promise of the Greenspan Put, promising endless monetary inflation in the name of propping up financial markets. The seeds of the next inflation were being planted.

Nonetheless, Arthur Burns serves as an important cautionary tale. Burns believed he could end price inflation through small-scale short-term tinkering that did not involve the unpleasant work of popping bubbles and liquidating malinvestments that had sprung up due to previous monetary inflation. This, combined with ending monetary inflation, is the only way that inflation can ultimately be “fixed.”

Jerome Powell appears to subscribe to the Burnsian way of thinking, however. If his comments in congressional testimony and press conferences are any indication, Powell still believes it is possible to “solve” price inflation through extremely mild increases to key interest rates and through miniscule reductions in the scale of the Fed’s portfolio.

It is entirely possible that this plan will give the appearance of “working.” After all, the US economy is so dependent on easy money from the central bank at this point that it may not take much monetary tightening to bring on a short recession of the sort we saw repeatedly in the ’70s. That’s probably the direction we’re headed in now.

The larger question, however, is whether or not Powell’s ultramild tightening plans will be enough to truly end the bubble economy that we’re now living in. After thirteen years of “unconventional” monetary policy, countless bubbles have been created and can only survive so long as the Fed keeps the easy money coming. There is no sign inside the Fed of the political will necessary to pop these bubbles. Chairman Powell claims that he admires Volcker, but it’s increasingly clear Powell is really a student of Burns.

1. Ricardo Reis, “Losing the Inflation Anchor,” Brookings Papers on Economic Activity, Fall 2021, 318.

2. For a full chronology of these rate changes from 1971 to 1998, see Peter Garavuso to Oliver Giesecke, August 29, 2019, FOMC FOIA release, FOMC FOIA Tracking Number 2019-019.