Nothing moves a stock like Breaking News.

Nearly every morning, a handful of stocks pop in premarket off a news announcement.

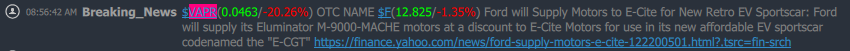

That’s what made E-Cite Motors (OTC: VAPR) rather unique.

News came out just before 9:00 a.m.

A partnership with Ford is a huge deal for a tiny EV company.

Yet, shares barely budged in the premarket.

However, when the regular session began, shares immediately jumped +10%.

After only a few seconds, I jumped in at $0.058 and sold a few minutes later at $0.075 for a nice gain.

See all my trades here at profit.ly

This trade offers a unique opportunity to dig into how I identify and enter trades.

Because it’s one thing to say I use price action to trade.

It’s another to SHOW how I do it.

And I take you in my mind, a whole new world of opportunities will open up before you.

Setup Selection

© Millionaire Media, LLC

First things first.

Before I jump into any trade, I make sure it fits my setup criteria.

Now, I don’t necessarily have hard and fast rules, more guidelines.

My goal is to exploit inefficiencies in the markets, especially the OTC.

So, I want tangible reasons why a stock could spike.

These include:

Hot sector

Former runner

Real news catalyst (this is a big one)

Hot market

It’s all about the context. Think of it like a story that’s written by each of the components.

With VAPR all of these pieces fit.

Electric vehicles are still in the news.

The stock ran hard less than a week ago.

Since that run, the stock is down 50% from its highs.

The partnership gives VAPR legitimacy.

Many OTC stocks have been running hard in the last month or so.

Every trader that joins my millionaire challenge wants to know which news events to trade.

This is how you know.

I realize that it’s not black and white. However, it doesn’t need to be difficult.

With practice, you’ll be able to identify which stories act as catalysts before the stock moves.

My Entry

Let’s look at the chart so you can see what the first few seconds of trading looked like in the name.

Despite the news hitting before the open, shares barely budged.

It wasn’t until the open that volume hit the stock.

So, looking at the order flow, I bought into the stock, only getting a partial fill.

I expected one of two things to occur:

Shares would continue higher as more people digested the news

We’d hit a wall of sellers

Thankfully, the first scenario occurred.

But what would have happened had I hit a wall of selling pressure?

Ideally, the stock would trade sideways for a couple of minutes on heavy volume, giving me an opportunity to exit close to my entry.

Worst case, I could use the low of the day as my stop.

Managing the Speed

© Millionaire Media, LLC

All of this requires you to make split-second decisions.

This isn’t something that comes naturally or quickly.

I practiced these setups for years.

Starting out, keep your size smaller. Don’t be afraid to stop out back at your entry.

As you progress, use simple rules for your trades to enter and exit.

Wait for a wall of buyers to enter an OTC stock on a pullback.

When you see volume increase while price stops moving as much, consider taking profits.

Final Thoughts

Setups like these may not be your cup of tea either.

I teach my students many different ways to analyze stocks and trade chart patterns like my Supernova.

Work with ones you are comfortable with to start and then branch out from there.

–Tim

The post My Trigger to Enter $VAPR appeared first on Timothy Sykes.