[Originally published by Law&Liberty.]

The celebrated Paul Volcker (1927-2019) became Chairman of the Federal Reserve Board 43 years ago on August 6, 1979. The 20th-century Great Inflation, stoked by the Federal Reserve and the other central banks of the day, was in full gallop in the U.S and around the world. In the month he started as Chairman, U.S. inflation continued its double-digit run—that August suffered a year-over-year inflation rate of 11.8%. On August 15, the Federal Reserve raised its fed funds mid-target range to 11%, but that was less than the inflation rate, so a nominal 11% was still a negative real interest rate. How bad could it get? For the year 1979, the December year-over-year inflation was an even more awful 13.3%. At that compound rate, the cost of living would double in about five years.

Everybody knew they had an inflationary disaster on their hands, but what could be done? They had already tried “WIN” (“Whip Inflation Now”) buttons, but inflation was whipping them instead. In this setting, “The best professional judgment among leading economists was that Americans should view the problem of inflation as being…intractable,” wrote Volcker’s biographer, William Silber. Leading Wall Street forecaster Henry Kaufman, for example, was pessimistic in 1980, opining “that he had ‘considerable doubt’ that the Fed could accomplish its ultimate objective, which is to tame inflation. He added for good measure that the Fed no longer had ‘credibility in the real world.”

Those days are now most relevant. Although Silber could write in 2012, “Inflation is ancient history to most Americans,” today it is upon us once again. What can we re-learn?

From Burns to Volcker

In September 1979, Arthur Burns, who had been Fed Chairman from 1970 to 1978, gave a remarkable speech entitled “The Anguish of Central Banking.” Discussing “the reacceleration of inflation in the United States and in much of the rest of the word,” “the chronic inflation of our times,” and “the world wide disease of inflation,” he asked, “Why, in particular, have central bankers, whose main business one might suppose is to fight inflation, been so ineffective?”

We may observe to the contrary that they had been very effective—but in producing inflation instead of controlling it, just as their 21st-century successors were effective in producing first the asset price inflation of the Everything Bubble, which is now deflating, and then destructive goods and services inflation, much to their own surprise. In both centuries, inflation was not an outside force attacking them, as politicians and central bankers both then and now like to portray it, but an endogenous effect of government and central bank behavior.

In what one might imagine as a tragic dramatic soliloquy, Burns uttered this cri de coeur: “And yet, despite their antipathy to inflation and the powerful weapons they could wield against it, central bankers have failed so utterly in this mission in recent years. In this paradox lies the anguish of central banking.”

I suspect the central bankers of 2022 in their hearts are feeling a similar anguish. Their supporting cast of government economists should be, too. “Economists at both the Federal Reserve and the White House were blindsided,” as Greg Ip wrote. “Having failed to anticipate the steepest inflation in 40 years,” he mused, “you would think the economics profession would be knee-deep in postmortems”—or some confessions of responsibility. But no such agonizing reappraisals as Burns’ speech seem forthcoming.

Reflecting that “Economic life is subject to all sorts of surprises [which] could readily overwhelm and topple a gradualist timetable,” in 1979 Burns announced that “I have reluctantly come to believe that fairly drastic therapy will be needed to turn the inflationary psychology around.” This was correct except for the modifier “fairly.” But, Burns confessed, “I am not at all sure that many of the central bankers of the world…would be willing to risk the painful economic adjustments that I fear are ultimately unavoidable.”

In our imagined drama of the time, enter Volcker, who was willing. He proceeds with firm steps to center stage. Burns fades out.

“If Congress had doubts about Volcker’s intentions,” says Allan Meltzer’s A History of the Federal Reserve, “they should have been dispelled by his testimony of September 5 [1979]”—one month after he took office. “Unlike the Keynesians, he considered the costs [of inflation] higher than the costs of reducing inflation.” Said Volcker to Congress, “Our current economic difficulties…will not be resolved unless we deal convincingly with inflation.”

In a television interview later that month, he was equally clear: “I don’t think we can stop fighting inflation. That is the basic, continuing problem that we face in this economy, and I think until we straighten out the inflation problem, we’re going to have problems of economic instability. So it’s not a choice….”

But what would it take to put into reverse the effects of years of undisciplined money printing, which accompanied oil supply and price shocks and other bad luck? Under the cover of restricting the growth in the money supply, Volcker’s strategy involved letting interest rates rise in 1980-81 to levels unparalleled, then or since, and to become strongly positive in real terms. Fed funds rates rose to over 20%. Ten-year Treasury notes to over 15%. Thirty-year fixed rate mortgage rates rose to over 18%. The prime rate reached 21.5%.

It is not clear whether Volcker ever took seriously the monetarist doctrine of focusing on the money supply, which he later abandoned, or simply used it as a pragmatic way to do what he wanted, which was to stop the runaway inflation. It is clear that he firmly rejected the Keynesian Phillips Curve approach of trying to buy employment with inflation. That had led central banks into inflationary adventures and resulted in simultaneous high inflation and high unemployment—the “stagflation” of the late 1970s, to which many think we risk returning in 2022.

The Double Dip Recessions

The Volcker program triggered a sharp recession from January 1980, five months after he arrived, to July 1980, and then a very deep and painful recession from July 1981 to November 1982—“double dip recessions.” Both hit manufacturing, goods production, and housing particularly hard, and generated the hard times of the “rust belt.” In 1982, unemployment rose to 10.8%, worse than the “Great Recession” peak unemployment of 10.0% in 2009.

“The 1981-82 recession was the worst economic downturn in the United States since the Great Depression,” says the Federal Reserve History. “The nearly 11% unemployment reached in late 1982 remains the apex of the post-World War II era [until surpassed in the Covid crisis of 2020]…manufacturing, construction and the auto industries were particularly affected.”

There were thousands of business bankruptcies. “The business failure rate has accelerated rapidly,” wrote the New York Times in September 1982, “coming ever closer to levels not seen since the Great Depression.” The total of over 69,000 business bankruptcies in 1982 was again worse than in the “Great Recession” year of 2009, which had 61,000.

The extreme interest rates wiped out savings and loan institutions, formerly the backbone of American mortgage finance, by the hundreds. The savings and loan industry as a whole was insolvent on a mark-to-market basis. So, in 1981, was the government’s big mortgage lender, Fannie Mae. A friend of mine who had a senior position with the old Federal Home Loan Bank Board recalls a meeting with Volcker at the time: “He was telling us he was going to crush the savings and loans.” There were securities firm and bank failures and then the massive defaults on the sovereign debt of “less developed countries” (“LDCs” in the jargon of the time), starting in August 1982. These defaults put the solvency of the entire American banking system in question.

This was a really dark and serious downer, but Volcker was firm about what he was convinced was the long-run best interest of the country. Was it debatable? Certainly.

There was plenty of criticism. Volcker wrote: “There were, of course, many complaints. Farmers once surrounded the Fed’s Washington building with tractors. Home builders, forced to shut down, sent sawed-off two-by-fours with messages…. Economists predictably squabbled.… Community groups protested at our headquarters….My speeches were occasionally interrupted by screaming protestors, once by rats let loose in the audience….” And “the Fed insisted I agree to personal security escort protection.”

In the government, Congressman Henry Reuss “reminded Volcker that the Constitution gave the monetary power to Congress”—as it does. “Congressman Jack Kemp called for Volcker’s resignation.” At the U.S. Treasury, “Secretary Donald Regan, a frequent critic, considered legislation restoring the Treasury Secretary to the [Federal Reserve] Board.” “Senator [Robert] Byrd introduced his bill to restrict Federal Reserve independence by requiring it to lower interest rates.” Inside the Federal Reserve Board, Governor Nancy Teeters, citing failures, the economy, high long-term interest rates, and high unemployment, objected in May 1982, “We are in the process of pushing the economy not just into recession, but into depression…I think we’ve undertaken an experiment and we have succeeded in our attempt to bring down prices…But as far as I’m concerned, I’ve had it.”

The minutes of the Federal Open Market Committee consistently display the intense uncertainty which marked the entire disinflationary project. “Volcker expressed his uncertainty frequently,” Meltzer observes, as he told the FOMC, for example: “I don’t know what is going to happen in the weeks or months down the road, either to the economy or to the aggregates or these other things,” or as he told Congress, “How limited our ability is to project future developments.” To his perseverance, add honesty. The same deep uncertainty will mark the Fed’s debates and actions in 2022 and always.

The 1982 recession finally ended in November. Inflation in December 1982 was 3.8% year-over-year. The fed funds rate was 8.8%. The year 1982 also saw the start of the two-decade bull market in stocks, and the 40-year bull market in bonds.

Meltzer speculated that the recession was more costly and “probably lasted longer than necessary.” Could a less severe recession have achieved the same disinflation? About such counterfactuals we can never know, but the current Fed must certainly hope so.

In 1983, President Ronald Reagan reappointed Volcker as Fed Chairman. In 1984, Reagan was re-elected in a landslide, the economy was booming, and inflation was 3.9%.

When Volcker left office in August 1987, inflation was still running at 4%, far from zero, but far below the 13% of 1979 when he had arrived as Fed Chairman. Real GDP growth was strong; fed funds were 6.6%. “The Great Inflation was over, and markets recognized that it was over.” Endemic inflation, however, was not over.

Volcker’s Legacy

On top of the pervasive uncertainty, the Federal Reserve worried constantly during the Volcker years, as it must now, about its own credibility. Meltzer believed Volcker’s lasting influence was to “restore [the Federal Reserve] System credibility for controlling inflation.” But a generation after Volcker, the Fed committed itself to perpetual inflation at the rate of 2% forever. At the 2% target rate, prices would quintuple in an average lifetime. That is obviously not the “stable prices” called for in the Federal Reserve Act, but the Fed kept assuring everybody it was “price stability.” Volcker made clear his disagreement with this 2% target, writing of it in 2018, “I know of no theoretical justification. … The real danger comes from encouraging or inadvertently tolerating rising inflation.”

The classic monetary theorist Irving Fisher had warned, as have many others, that “Irredeemable paper money has almost invariably proved a curse to the country employing it.” Silber reflects that “The 1970s nearly confirmed Irving Fisher’s worst fears.” I would delete the word “nearly” from that last sentence.

The inflationary problems of Volcker’s days and ours are fundamentally linked to the demise of the Bretton Woods system in 1971, when the United States reneged on its international commitment to redeem dollars in gold. This put the whole world on pure fiat money instead, with fateful results. According to Brendan Brown, “Volcker considered the suspension of gold convertibility…’the single most important event of his career.’” Indeed, it created the situation which put him on the road to future greatness. Ironically, Volcker began as a strong supporter of the Bretton Woods system, but then helped dismantle it. Of course, he was always an ardent anti-inflationist. “Nothing is more urgent than the United States getting its inflation under control,” he had already written in a formal Treasury presentation in 1969.

“Inflation undermines trust in government,” Volcker said. That it does, and such loss of trust is justified, then and now. Putting the thought another way, Volcker deeply believed that “Trust in our currency is fundamental to good government.” Throughout his life, he did his best to make the U.S. dollar trustworthy.

In retrospect, Volcker became “an American financial icon.” He elicits comments such as this one: “I knew Paul Volcker (who slew the Great Inflation). Volcker stopped inflation in the 1980s….” Or: “Volcker was the Federal Reserve knight who killed inflation.” Or: “Volcker and his FOMC…did what they thought was necessary, generating enormous pain but finally stamping out inflation. I hope Jerome Powell will find his inner Volcker.” As we have seen, Volcker didn’t actually stop or kill or stamp out inflation, but he brought it down from runaway to endemic.

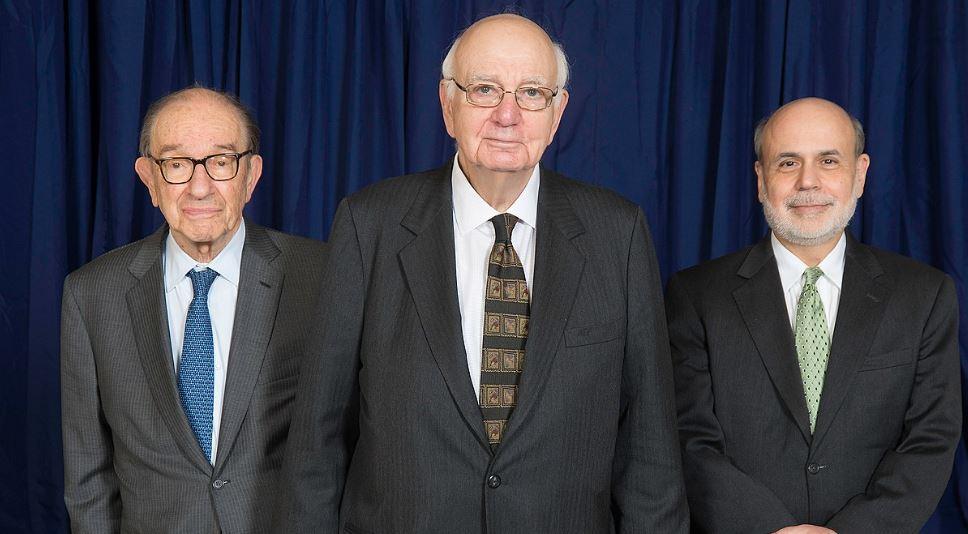

His successor as Fed Chairman, Alan Greenspan, said “We owe a tremendous debt of gratitude to Chairman Volcker and the Federal Open Market Committee for…restoring the public’s faith in our nation’s currency.”

In 1990, Volcker spoke in the same Per Jacobsson Lecture series which had been the site of Arthur Burn’s anguish eleven years before. A similar audience of central bankers and finance ministers this time was treated to “The Triumph of Central Banking?” This included “my impression that central banks are in exceptionally good repute these days.”

However, he pointed out the question mark. “I might dream of a day of final triumph of central banking, when central banks are so successful in achieving and maintaining price and financial stability that currencies will be freely interchangeable at stable exchange rates” (shades of his earlier commitment to Bretton-Woods). “But that is not for my lifetime—nor for any of yours.” About that he was right, and also right about a more important point: “I think we are forced to conclude that even the partial victory over inflation is not secure.” There he was wiser than his many eulogists, as is obvious in 2022.

In discussions of the current inflation, including similarities to the 1970s, references to Volcker are frequent and laudatory. For example, “Federal Reserve Chairman Jerome Powell has taken of late to praising legendary Paul Volcker, as a signal of his new inflation-fighting determination.” Or “Powell tried to engage in some plain speaking, by telling the American people that inflation was creating ‘significant hardship’ and that rates would need to rise ‘expeditiously’ to crush this. He also declared ‘tremendous admiration’ for his predecessor Paul Volcker, who hiked rates to tackle inflation five decades ago, even at the cost of a recession.”

No Permanent Victories

With the model of Volcker in mind, will we now experience parallels to the 1981-82 recession, as well? This is the debate about whether a “soft landing” is possible from where the central banks have gotten us now. If we repeat the pattern of the 1980s, it will not be a soft landing and the cost of suppressing inflation will again be high, but worth it in the longer run. It should rightly be thought of as the cost of the previous central bank and government actions that brought the present inflation upon us.

Silber concluded that in the 1980s, “Volcker rescued the experiment in fiat currency from failure.” But experimentation with fiat currency possibilities has continued, including the creation of a giant portfolio of mortgage securities on the Fed’s own balance sheet, for example. When politicians and central bankers are hearing the siren song of “just print up some more money”—a very old idea recently called modern in “modern” monetary theory— in whatever guise it may take, who will provide the needed discipline, as Volcker did? Under various versions of the gold standard, it might be a matter of “what” provides monetary discipline, but in the fiat currency world of Volcker’s time and now, it is always and only a question of “who.”

Volcker wrote that “Bill Martin [William McChesney Martin, Fed Chairman 1951-70]… is famous for his remark that the job of the central bank is to take away the punch bowl just when the party gets going.” Unfortunately, Volcker continued, “the hard fact of life is that few hosts want to end the party prematurely. They wait too long and when the risks are evident, the real damage is done”—then it is already too late and the problem has become a lot harder. Like now.

As has been truly said, “In Washington, there are no permanent victories.” Volcker’s victory over runaway inflation was not permanent, because the temptation to governments and their central banks of excessive printing, monetization of government deficits, and levying inflation taxes is permanent. In 2021-22, we are back to disastrously high inflation, recognize the need to address it, and feel the costs of doing so. And Chairman Powell is citing Chairman Volcker.

But are there factors, four decades later, making the parallels less close? For example, international investor Felix Zulauf “thinks the Powell Fed is quite different from the Volcker Fed, and not just because of the personalities. It’s in a different situation and a different financial zeitgeist [and different political zeitgeist]. He doesn’t think the Fed, or any other central bank can get away with imposing the kind of pain Volcker did and will stop as soon as this year.” (italics added)

Suppose that is right—what then? Then the pain will come from continued inflation instead. There is now no avoiding pain, which will come in one way or the other.

A similar, though more strident, argument from June 2022 is this: “It will be politically impossible to raise rates enough to stop inflation. … Volcker raised rates to 19%. There is no way the Fed is going anywhere near that.…You may recall the Fed not long ago said they…were just talking about raising rates.” And echoing Henry Kaufman in 1980, “None of them has any credibility anymore.”

We must admit that the current fed funds rate of 1.75% with an inflation of 8.5%, for a real fed funds rate of negative 6.75%, is hardly Volckeresque. Indeed, there is nothing Volkeresque yet. Interest rates in 1980-81 went far higher than most people imagined possible—perhaps they will again go higher than now thought possible and maybe we will even see positive real interest rates again.

Chairman Powell was a Fed Governor and Chairman while the wind of the present inflation was being sown, and he is there to reap the whirlwind. Will the Fed under his leadership tame it and at what cost, as all the maladjustments and the financial dependence of both the government and private actors on negative real rates and cheap leverage during the last decade must now be corrected?

We might imagine a hypothetical case in which Paul Volcker was 40 years younger, and with his unyielding commitment to trustworthy money and his insistence that achieving it is worth the cost, had become the new Fed Chairman in 2022. We can speculate about what he would be and could be doing now.

But in the real case, just as Volcker did beginning in 1979, Chairman Powell has now stepped to center stage in the current drama. We cannot yet say whether his future valedictory lecture will be about the Anguish or the Triumph of central banking.