Is praxeology inconsistent? Praxeologists criticize neoclassical economists for using false assumptions in their models. For example, neoclassicals acknowledge that the conditions for “perfect competition” are never found in the actual world. Firms selling a good such as wheat may not have much control over price, but they aren’t perfect “price takers,” as perfect competition requires. Nevertheless, the model is useful, neoclassicals aver, for generating predictions about the real-world behavior of certain firms.

Austrian praxeologists disagree. If you start out with false assumptions, what you deduce from these assumptions is not guaranteed to be true. It is wrong that what is deduced from false assumptions is always false; the conclusion might in fact be true. The problem is that the premises do not give grounds for thinking it is true. “All elephants are mortal; Socrates is an elephant; therefore, Socrates is mortal” reaches a true conclusion, but because the argument uses the false premise “Socrates is an elephant,” the argument lends the conclusion no support. Praxeologists, by contrast, start out with true premises, such as the action axiom, and endeavor to deduce true conclusions from them.

Here is where the alleged inconsistency is supposed to arise. Austrians also use “imaginary constructions,” such as the evenly rotating economy (ERE) and the final state of rest, which can never exist in the actual world. How can Austrians assail neoclassicals for their unreal assumptions while using unreal assumptions themselves?

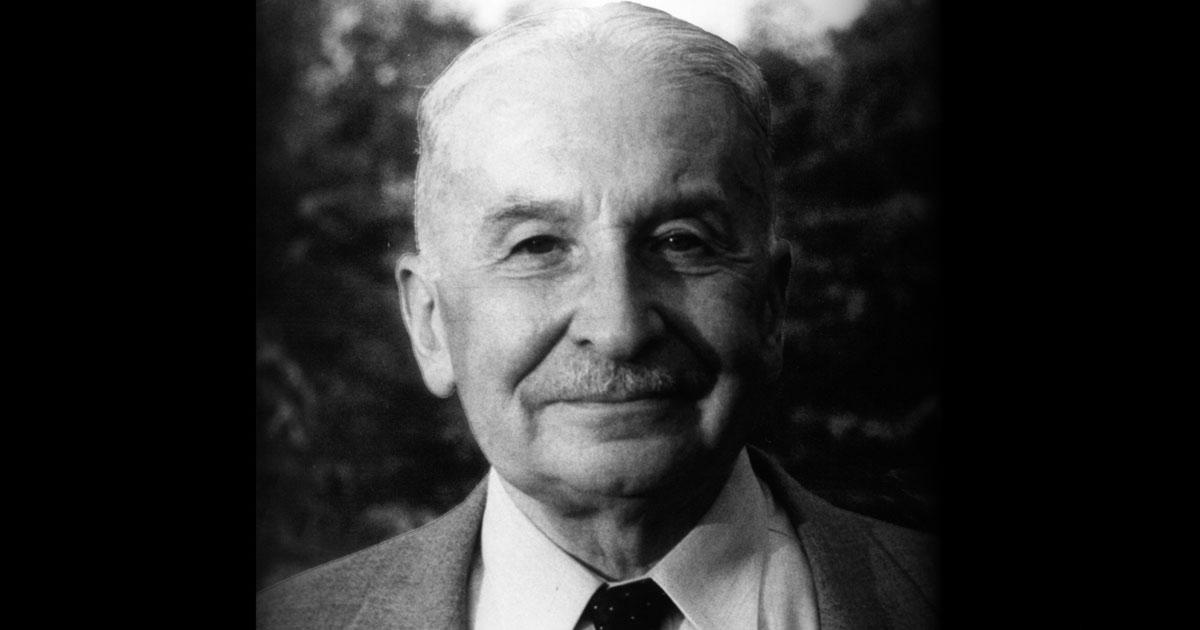

I think this inconsistency can easily be solved through careful consideration of what Ludwig von Mises says in Human Action about imaginary constructions, and I’ll quote the relevant passage and then comment on it.

The specific method of economics is the method of imaginary constructions…. An imaginary construction is a conceptual image of a sequence of events logically evolved from the elements of action employed in its formation. It is a product of deduction, ultimately derived from the fundamental category of action, the act of preferring and setting aside. In designing such an imaginary construction the economist is not concerned with the question of whether or not it depicts the conditions of reality which he wants to analyze. Nor does he bother about the question of whether or not such a system as his imaginary construction posits could be conceived as really existent and in operation. Even imaginary constructions which are inconceivable, self-contradictory, or unrealizable can render useful, even indispensable services in the comprehension of reality, provided the economist knows how to use them properly.

The method of imaginary constructions is justified by its success. Praxeology cannot, like the natural sciences, base its teachings upon laboratory experiments and sensory perception of external objects. It had to develop methods entirely different from those of physics and biology. It would be a serious blunder to look for analogies to the imaginary constructions in the field of the natural sciences. The imaginary constructions of praxeology can never be confronted with any experience of things external and can never be appraised from the point of view of such experience. Their function is to serve man in a scrutiny which cannot rely upon his senses. In confronting the imaginary constructions with reality we cannot raise the question of whether they correspond to experience and depict adequately the empirical data. We must ask whether the assumptions of our construction are identical with the conditions of those actions which we want to conceive.

The main formula for designing of imaginary constructions is to abstract from the operation of some conditions present in actual action. Then we are in a position to grasp the hypothetical consequences of the absence of these conditions and to conceive the effects of their existence. Thus we conceive the category of action by constructing the image of a state in which there is no action, either because the individual is fully contented and does not feel any uneasiness or because he does not know any procedure from which an improvement in his well-being (state of satisfaction) could be expected. Thus we conceive the notion of originary interest from an imaginary construction in which no distinction is made between satisfactions in periods of time equal in length but unequal with regard to their distance from the instant of action.

The method of imaginary constructions is indispensable for praxeology; it is the only method of praxeological and economic inquiry. It is, to be sure, a method difficult to handle because it can easily result in fallacious syllogisms. It leads along a sharp edge; on both sides yawns the chasm of absurdity and nonsense. Only merciless self-criticism can prevent a man from falling headlong into these abysmal depths.

The point Mises is making here is a simple one. When praxeologists use imaginary constructions, they aren’t claiming to deduce truths about what happens in the real world. At no point is it proposed, for example, to test empirically how close the economy comes to the ERE. Finding out what necessarily happens in the real world requires starting with true premises. But the imaginary constructions enable praxeologists to understand better the action axiom and the theorems deduced from it, by allowing them to contrast these true statements with the false assumptions of the constructions.

One aspect of this procedure requires clarification. It’s only some of the assumptions of the imaginary constructions that are false. The deductive procedures used in drawing consequences from these assumptions are correct. If they weren’t, the constructions would be useless for the purpose Mises sets out for them; viz., contrasting what takes place in them with what happens in the world.

This raises a problem to which I don’t have a solution and which I’ll leave to readers. Is Mises going too far when he says that the assumptions of the imaginary constructions can be self-contradictory? There is a well-known argument in logic which shows that a self-contradiction materially implies any proposition. Unless you can “get around” this problem, the conclusions you draw from the imaginary constructions will be useless for economic analysis. I suspect that the answer lies in using a notion of “inconceivable” that isn’t equivalent to strict logical self-contradiction, but I’ll leave it to readers more adept at these matters than I to unravel this.