[Reprinted with permission of the authors.]

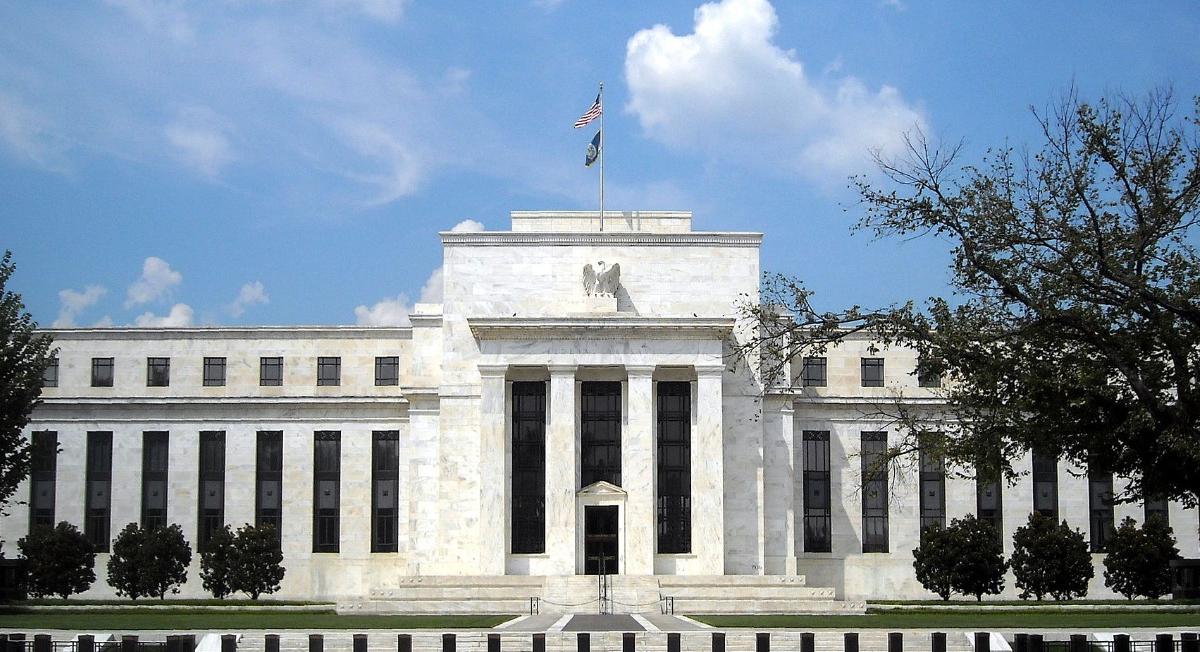

The year 2023 is shaping up to be a challenging one for the Federal Reserve System.

The Fed is on track to post its first annual operating loss since 1915. Per our estimates, the loss will be large, perhaps $100 billion or more, and this cash loss does not count the unrealized mark-to-market losses on the Fed’s massive securities portfolio. An operating loss of $100 billion would, if properly accounted for, leave the Fed with negative capital of $58 billion at year-end 2023.

At current interest rates, the Fed’s operating losses will impact the federal budget for years, requiring new tax revenues to offset the continuing loss of billions of dollars in the Fed’s former remittances to the U.S. Treasury.

The Federal Reserve has already confirmed a substantial operating loss for the fourth quarter of 2022. Audited figures must wait for the Fed’s annual financial statements, but a preliminary Fed report for 2022 shows a fourth-quarter operating loss of over $18 billion. The weekly Fed H.4.1 reports suggest that after December’s 50 basis point rate hike, the Fed is losing at a rate of about $2 billion a week. This weekly loss rate when annualized totals a $100 billion or more loss in 2023. If short-term interest rates increase further, operating losses will increase. Again, these are cash losses and do not include the Fed’s unrealized, mark-to-market loss, which it reported as $1.1 trillion on Sept. 30.

The Fed obviously understood its risk of loss when it financed about $5 trillion in long-term, fixed-rate, low-yielding mortgage and Treasury securities with floating-rate liabilities. These are the net investments of non-interest-bearing liabilities—currency in circulation and Treasury deposits—thus investments financed by floating rate liabilities.

These quantitative easing purchases were a Fed gamble. With interest rates suppressed to historically minimal levels, the short-funded investments made the Fed a profit. But these investments, so funded, created a massive Fed interest rate risk exposure that could generate mind-boggling losses if interest rates rose—as they now have.

The return of high inflation required the Fed to increase short-term interest rates, which pushed the cost of the Fed’s floating-rate liabilities much higher than the yield the Fed earns on its fixed-rate investments. Given the Fed’s 200-to-1 leverage ratio, higher short-term rates quickly turned the Fed’s previous profits into very large losses. The financial dynamics are exactly those of a giant 1980s savings and loan.

To cover its current operating losses, the Fed prints new dollars as needed. In the longer run, the Fed plans to recover its accumulated operating losses by retaining its seigniorage profits (the dollars the Fed earns managing the money supply) in the future once its massive interest rate mismatch has rolled off. This may take a while since the Fed reports $4 trillion in assets with more than 10 years to maturity. During this time, future seigniorage earnings that otherwise would have been remitted to the U.S. Treasury, reducing the need for Federal tax revenues, will not be remitted.

While not widely discussed at the time, the Fed’s quantitative easing gamble put taxpayers at risk should interest rates rise from historic lows. The gamble has now turned into a buy-now-pay-later policy—costing taxpayers billions in 2023, 2024 and perhaps additional years as new tax revenues will be required to replace the revenue losses generated by quantitative easing purchases.

The Fed’s 2023 messaging problem is to justify spending tens of billions of taxpayer dollars without getting congressional pre-approval for the costly gamble. Did Congress understand the risk of the gamble? The Fed tries to downplay this embarrassing predicament by arguing that it can use non-standard accounting to call its growing losses something else: a “deferred asset.” The accumulated losses are assuredly not an asset but properly considered are a reduction in capital. The political fallout from these losses will be magnified by the fact that most of the Fed’s exploding interest expense is paid to banks and other regulated financial institutions.

When Congress passed legislation in 2006 authorizing the Fed to pay interest on bank reserve balances, Congress was under the impression that the Fed would pay interest on required reserves, and a much lower rate of interest—if anything at all—on bank excess reserve balances. Besides, at the time, excess reserve balances were very small, so if Fed did pay interest on excess reserves, the expense would have been negligible.

Surprise! Since 2008, in response to events unanticipated by Congress and the Fed, the Fed vastly expanded its balance sheet, funding Treasury and mortgage securities purchases using bank reserves and reverse repurchase agreements. The Fed now pays interest on $3.1 trillion in bank reserves and interest on $2.5 trillion in repo borrowings, both of which are paid at interest rates that now far exceed the yields the Fed earns on its fixed-rate securities holdings. The Fed’s interest payments accrue to banks, primary dealers, mutual funds and other financial institutions while a significant share of the resulting losses will now be paid by current and future taxpayers.

It was long assumed that the Fed would always make profits and contribute to Federal revenues. In 2023 and going forward, the Fed will negatively impact fiscal policy—something Congress never intended. Once Congress understands the current and potential future negative fiscal impact of the Fed’s monetary policy gamble, will it agree that the looming Fed losses are no big deal?

[Reprinted with permission of the authors.]