Chris Edwards

Senate Finance Committee Chair Ron Wyden (D‑OR) held a hearing last week to counter the House Republican plan to cut the recent IRS enforcement boost. Sen. Wyden said, “If you’re looking for the big winners of the McCarthy IRS defunding plan, it’s billionaires and corporations who cheat on their taxes … Repealing that funding is a $191 billion giveaway to wealthy tax cheats.”

I offered a different view at the hearing. I noted that tax enforcement imposes collateral damage, that the tax gap has been stable for decades, and that the U.S. tax gap appears to be smaller than Europe’s. The “tax gap” means unpaid taxes from errors and cheating.

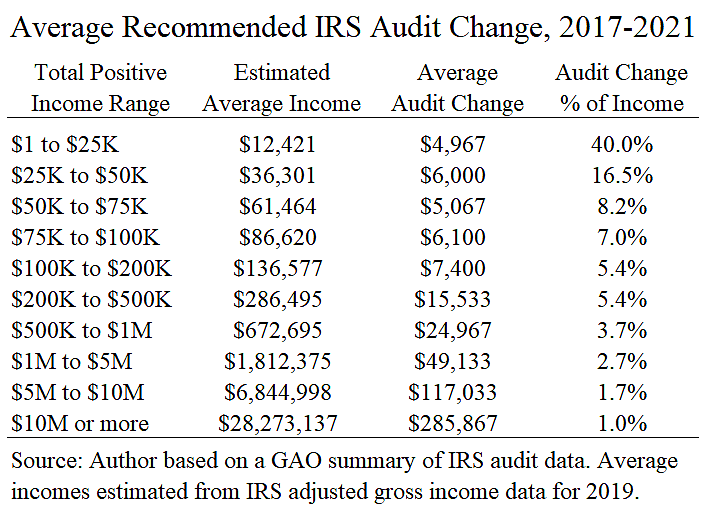

Here’s one problem with Sen. Wyden’s view: IRS audits find relatively smaller errors and cheating on higher‐income returns than lower‐income returns. As shown in the table below, IRS audits recommend additional tax of 5 to 8 percent of income for middle‐income households, but just 1 to 4 percent of income for high‐income households. These are averages within income groups over 2017 to 2021.

For example, for households facing additional tax, the average is $6,100 for those earning $75,000 to $100,000, which is 7.0 percent of income, and it is $117,033 for those earning $5 million to $10 million, which is 1.7 percent of income. Note that the average audit change of $117,033 for this high‐income group may seem large, but that is just 6 percent of the average tax paid by these households. Also note that the large relative audit change in the bottom group mainly stems from errors and cheating on the earned income tax credit.

Why does the IRS find relatively smaller errors and cheating at the top? It may because these households are more likely to hire expert accountants and lawyers who have their reputations on the line. The relatively smaller errors at the top are impressive, given that high‐income returns often involve complex issues such as business income and capital gains.

Data Notes. The IRS publishes aggregate results of audits in its annual Data Book. My table is based on a Government Accountability Office summary of the IRS data in GAO-22–104960 (p. 34).

The income groups are based on “total positive income” not adjusted gross income (AGI). However, the IRS and GAO do not appear to provide average total positive income within the income groups, so I roughly estimated it using average AGI for 2019 within AGI income groups.

A final note is that these are the additional taxes “recommended” by IRS auditors. But many taxpayers appeal these amounts and get them reduced. Also, some taxpayers challenge IRS audit results in court and many of them win, as discussed here.