Starting an investment portfolio may appear daunting, yet it’s a journey that begins with a single step.

Understanding where to start and which investment paths to explore can make the difference between flourishing and merely getting by in the financial realm. Let’s explore the strategies to help build an investment portfolio from scratch!

Understand Your Risk Tolerance

Identifying personal risk tolerance is a critical part of building an investment portfolio. Everyone’s approach to risk varies, depending mainly on individual financial situations, investment goals, and comfort levels with potential losses.

Here are a few strategies to help determine your risk tolerance:

Assess Your Financial Situation: Understand how much money you can afford to lose without affecting your lifestyle or financial stability.

Define Your Investment Goals: Identify what you want to achieve with your investments, whether it’s retirement planning, buying a home, or starting a business. The timeline for these goals significantly influences your risk tolerance.

Consult A Financial Advisor: A financial advisor can help evaluate your financial situation and determine an appropriate level of risk.

Remember, investments with higher risk often have the potential for higher returns. Properly gauging your risk tolerance can guide investment decisions and ensure peace of mind.

Set Clear Financial Goals

The initiation of an investment portfolio begins with setting clear financial goals. This essential step aids in clarifying the purpose behind investing and aligns the strategy accordingly. Here are a few helpful tips for setting financial goals effectively:

Begin With The End In Mind: Identify long-term objectives such as retirement, home purchase, or funding your child’s education.

Set Specific, Measurable Goals: Instead of saying ‘save more,’ pinpoint an exact dollar amount to aim for.

Establish A Timeline: Assign each financial goal a target date. This helps with creating realistic saving and investing plans.

Clear objectives generate an investment pathway and provide motivation to stay committed to it, fostering financial growth and stability.

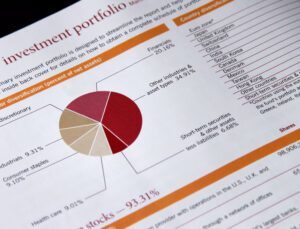

Choose And Diversify Your Investments

A crucial step in starting an investment portfolio is to aim for its diversification. Spreading investments across multiple types enables better risk management and potential enhancement of overall returns. This method ensures that even if one investment doesn’t perform well, others may compensate for the loss, smoothing out potential financial fluctuations.

Here are a few types of investments to consider when diversifying an investment portfolio:

Contracts For Differences (CFDs): So, what are CFDs? CFDs are derivative financial products that allow investors to speculate on the rising or falling prices of fast-moving global financial markets. They provide a pathway for engaging in various markets, including forex, indices, commodities, shares, and treasuries.

Stocks: Stocks are ownership shares in a corporation, allowing participation in the company’s growth and profits.

Bonds: Essentially, bonds are loans made to a corporation or government entity, offering fixed returns over a set period.

Mutual Funds: These are pooled investment vehicles managed by professionals, providing diversification within a single product.

Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds but traded on an exchange like a stock, offering broad market exposure.

Real Estate: Physical property or real estate investment trusts (REITs). They can provide both income and capital appreciation.

Commodities: These are physical goods such as gold, oil, or agricultural products, acting as a hedge against inflation.

Cryptocurrencies: Cryptocurrencies are digital or virtual currencies using cryptography for security. They are high-risk but potentially high-reward assets.

Incorporating various investment types in a portfolio can offer a balanced approach to achieving financial objectives while managing potential risk. Remember, each type has its own risk and return profile and must align with individual investment goals and risk tolerance.

Regularly Review And Rebalance The Portfolio

An essential part of starting an investment portfolio is regularly reviewing and rebalancing it. Over time, the portfolio’s risk profile might drift from the original design due to varying returns from different investments. Here are some tips for portfolio review and rebalancing:

Establish A Review Schedule: Determine a regular interval for review, such as quarterly, semi-annually, or annually.

Analyse Performance: Evaluate how each asset performs compared to its benchmarks, adjusting as necessary.

Rebalance As Needed: If any assets deviate significantly from their target allocation, rebalance by buying or selling.

Assess Risk Tolerance: Make sure the portfolio still matches your current comfort level with risk.

Stay Updated With Market Trends: Given the fluctuating nature of financial markets, regular updates can alert you to significant changes that might necessitate a portfolio adjustment.

Rebalancing helps to realign the portfolio with the desired risk level and investment goals, ensuring that it continues to be effective.

Consult a Financial Advisor

Consulting a financial advisor can provide the edge needed to maximize your investment portfolio’s performance and navigate the complex world of finance. These professionals come equipped with extensive knowledge of financial markets and trends. They can offer valuable advice on creating personalized investment strategies that align with your unique financial goals and risk tolerance.

Moreover, financial advisors assist in setting clear and achievable financial objectives, selecting appropriate investment types, effectively diversifying investments to mitigate risk, and establishing a schedule for regular portfolio reviews. This guidance can empower you to make informed financial decisions and foster portfolio growth.

Lastly, they can act as a guide, particularly for those new to investing, to navigate through market volatility and potential investment pitfalls. This way, they play an integral role in making your investment journey less daunting and more successful.

Embarking On Your Investment Journey

Starting an investment portfolio involves understanding risk tolerance, setting clear goals, diversifying investments, and choosing wisely. Regular reviews and consulting a financial advisor can further enhance the portfolio’s success. With patience, consistency, and a little bit of savvy, you’re all set to embark on this exciting financial journey.

Read more:

How To Start An Investment Portfolio