Depression-era bank robber Willie Sutton, when asked why he robbed banks, replied, “Because that’s where the money is.” By “money,” he meant United States currency. He never indicated how he scheduled his robberies, but some days of the year may be more profitable for bank robberies than others.

Disclaimer: Neither I nor the Mises Wire in any way endorses bank robbery, which is a federal crime.

First, here are some facts about US “folding money,” Federal Reserve notes in denominations of $1, $2, $5, $10, $20, $50, and $100. The Fed no longer issues $500, $1,000, $5,000, and $10,000 bills, but they are still legal tender and may still be in circulation.

This currency is printed by the Bureau of Engraving and Printing division of the US Treasury, then supplied to Federal Reserve banks for public circulation. Coins, on the other hand, are produced by the US Treasury at several mints around the country and then deposited at the Fed banks for circulation.

Recent reports show that the total currency in circulation (Federal Reserve notes and coins outside the US Treasury and Federal Reserve banks) is about $2.3 trillion.

The Role of Depository Institutions and the Public

Commercial banks, credit unions, and savings banks are the sources of currency whenever the public desires it. We expect banks to have sufficient vault cash to satisfy all withdrawal requests. How would you react if your bank or ATM ran out of cash and told you that they won’t have any until tomorrow?

Contrary to popular belief, the US Treasury and the Fed do not determine how much currency and coins circulate at any given time. Instead, the public decides how much of its wealth to hold in the form of cash versus other asset choices such as bank account deposits, stocks and bonds, collectibles, cryptocurrency, and real property.

Depository institutions, then, must determine the proper level of vault cash to maintain for their customers. For example, banks usually experience greater cash withdrawals during the summer months and three-day weekends when people tend to travel, shop, and visit entertainment venues.

How Depository Institutions Acquire Cash

If banks run low on cash and coins, they can request more from their local Federal Reserve bank, paying face value for the cash with the reserve accounts that they are required to maintain at the Fed. However, banks avoid maintaining too much vault cash because it is “dead money” that does not earn interest, whereas they do earn interest lending to customers or keeping excess reserves at the Fed.

The Fed will always have sufficient currency to meet customers’ requests because the 1913 Federal Reserve Act provided for an “elastic currency,” meaning a currency that would easily expand or contract in response to the public’s needs and preferences. Throughout US history, the banking system has been subject to periodic bank runs (called “panics”) when depositors demanded the balances of their accounts in cash if they didn’t trust the banks.

Bank runs this past year at Silicon Valley Bank, Signature Bank, and First Republic Bank occurred because of the speed at which large online withdrawals can be made and because the market value of these banks’ bond investments had fallen as interest rates had risen. The lack of bank vault cash was not a factor in these bank runs per se, as it had been in earlier times.

Cash Makes Round Trips among Consumers, Merchants, Banks, and the Fed

Note that after the public has spent the cash they had earlier withdrawn from banks, merchants normally deposit the cash into their own bank accounts, and banks then add it to their vault cash or return it to the Fed. Although some cash may be hoarded under the mattress or in safety deposit boxes, much of it makes regular round trips in and out of bank vaults and Fed banks, which is exactly what currency elasticity was designed for.

Note also that the “elastic currency” paradigm works equally well whether the US dollar is gold-backed or is a fiat currency. The US was on a full gold standard when the Fed was created in 1913, with gold coins in circulation until Franklin Roosevelt called in those coins in 1933. The US dollar has been a fiat currency since 1971, when Richard Nixon “closed the gold window” and abandoned the Bretton Woods arrangement that had fixed the US dollar to gold.

Large Amounts of US Currency Are Held Abroad

The Federal Reserve Board of Governors estimates that foreigners hold about $1 trillion in Fed notes, representing about 45 percent of all notes outstanding, including two-thirds of all $100 bills. This US currency is accepted around the world in both legal and illegal transactions, including the international illicit drug trade.

Once the currency leaves the US, moreover, much of it tends to remain abroad permanently or for long periods of time. Interestingly, the “markup” on the currency’s value (the difference between its face value and the small cost of printing the notes) constitutes profit to the Fed (and ultimately to the US government and to American taxpayers). This profit is called “seigniorage.” If a $100 Federal Reserve note costs twenty cents to print, for example, the Fed’s profit on that bill is $99.80.

What Do These Facts Have to Do with Bank Robberies?

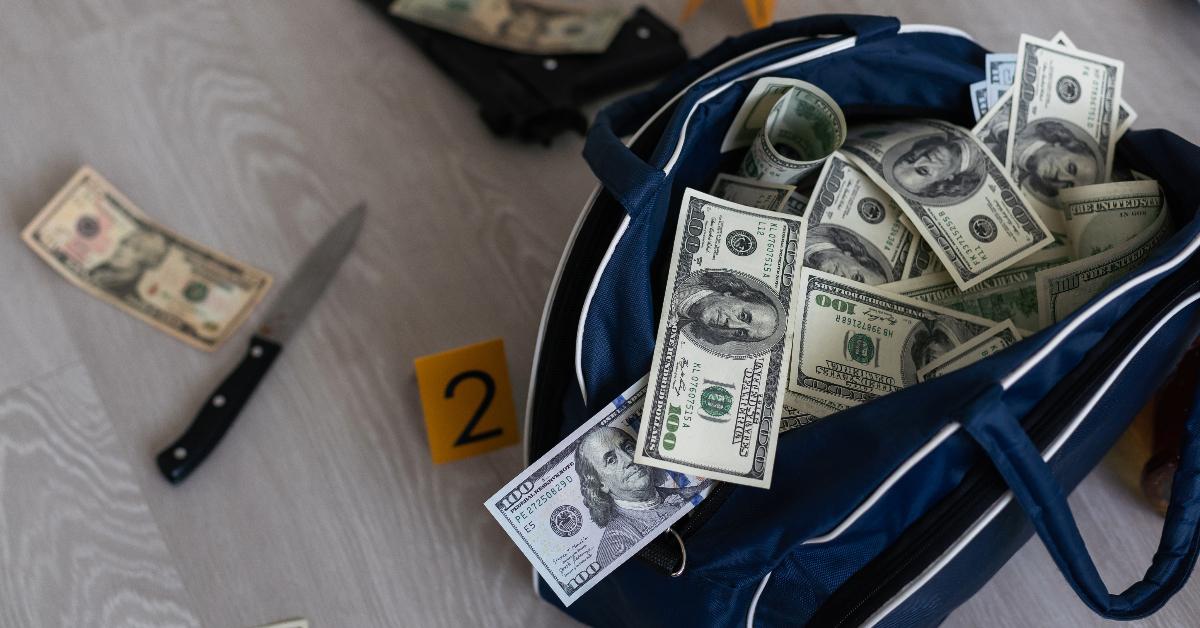

Bank robbers target currency that banks hold in tellers’ drawers and in the vault. Since the public determines how much currency is in circulation, banks maintain sufficient cash to satisfy the public’s demand, and the Fed can always supply enough cash to banks, when might a clever person ideally schedule a bank robbery?

Consider a robbery of a bank branch at a major regional shopping center in Seattle at about 5:30 p.m. on the day before Thanksgiving 1996. This is a true story, and retired Seattle police detective Ann Rule later wrote a book about the thieves: three colorful characters with a ringleader who became known as “Hollywood” because of his imaginative costumes. I was living in a nearby Seattle residential neighborhood at the time and recall the incident well.

We heard gunshots shortly before 6:00 p.m. that Wednesday and then the breaking story on the six o’clock news. These robbers, who had managed to elude law enforcement after previously robbing several other nearby banks, walked into the bank branch armed and costumed and successfully walked out minutes later with more than a million dollars in cash. None of the customers in the branch at the time attempted to intervene, and no one was harmed.

However, after their seemingly successful robbery, the threesome encountered some mishaps. Attempting to drive away from the scene of the crime with their loot, they were trapped in congested holiday rush-hour traffic. It was dark and pouring rain, this being Seattle in November. Stuffing as much of the cash as possible into backpacks, they abandoned their vehicle in the stalled traffic jam and began running through residential neighborhoods with police in pursuit.

They ran into the neighborhood I lived in, dodging police bullets. Two of them were shot and wounded, easily captured, later convicted of bank robbery, and sentenced to prison. The third robber, the mastermind of the escapade, was not apprehended and managed to find shelter in an abandoned camper in a homeowner’s backyard. He remained hidden in the camper from Wednesday night through Thanksgiving Day as police SWAT teams scoured the neighborhood, locking down the entire area because he was considered armed and dangerous. When the police discovered him in the camper, he refused to come out, and gunshots were exchanged. He ultimately died in the camper, his death deemed a suicide. HistoryLink.org has the complete news accounts of this story.

What can we conclude from this story? This bank branch at the major regional shopping center was supplied with sufficient cash to satisfy all customer demands over the busy four-day Thanksgiving holiday weekend. It was scheduled to close at 6:00 p.m. that Wednesday, remain closed during the holiday, then reopen for business on Friday and Saturday for the Black Friday kickoff of the Christmas shopping season.

These bank robbers were either serendipitously lucky to have scheduled their heist on the Wednesday before Thanksgiving or may likely have known that banks are normally flush with cash at such times. However, their plans quickly dissolved into failure, and their Thanksgiving that year ended badly.

As for the Federal Reserve, one might conclude that its responsibility for monetary policy may not align well with its responsibility to provide an elastic currency. The Fed’s policymakers failed to realize that price inflation was inevitable after years of near-zero interest rates and massive purchases of US Treasury bonds and mortgage-backed securities.

Thus, the Fed permits the government to “rob” its citizens through inflation. At the same time, however, the Fed’s policy of providing an “elastic” currency also provides bank robbers the opportunity to engage in a theft “windfall” as the central bank beefs up its currency deliveries to the banks.