Romina Boccia

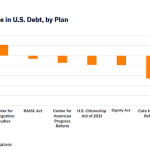

The US federal debt recently surpassed $34 trillion, a staggering figure just shy of the size of the US economy and about $100,000 for every US person. This development received modest attention in the news media, largely overshadowed by an ongoing government funding debate that’s dragged on since last spring.

Short‐term deadlines continue to suck up most of the energy in Congress at the cost of incurring high long‐term risks. But not everyone is complacent about the longer‐term fiscal challenges.

The House Budget Committee scheduled a bipartisan markup of three fiscal bills, taking place at 10 a.m. EST today (you can join me in following along here).

A committee markup is a big deal. During a markup, committee members debate and amend proposed legislation before advancing it to the floor. This process determines whether a bill should be recommended to the full House and, if so, in what form. With this markup, the committee is taking a formal step towards bringing more attention to the nation’s rapidly deteriorating fiscal state and advancing proposals to address it.

Of the three bills chairman Jodey Arrington (R‑TX) and members of the House Budget Committee will be marking up this week, the Fiscal Commission Act of 2023 would have the biggest potential impact. The other two bills, the Fiscal State of the Nation Act (H.R. 6952) and the Debt‐to‐GDP Transparency and Stabilization Act (H.R. 6957) would primarily advance transparency and public understanding by requiring that Congress receive a presentation from the Comptroller General about the fiscal state of the nation each year, and by reporting the debt as a percentage of GDP in the President’s Budget submission.

Understanding the Fiscal Commission Act of 2023 (H.R. 5779)

Introduced by the chairs of the Bipartisan Fiscal Forum, Representatives Bill Huizenga (R‑MI) and Scott Peters (D‑CA), this proposal would establish a sixteen‐member fiscal commission, composed of twelve lawmakers and four independent experts. All members would be appointed by House and Senate leadership from both parties.

The commission would aim to generate a reform package to stabilize the debt at no more than 100 percent of GDP within 10 years. Proposals should address the growth in direct spending (so‐called mandatory programs, including major entitlements), and narrowing the gap between projected federal expenditures and revenues over the long‐term. The committee is also instructed to improve the 75‐year solvency of any programs governed by trust funds (Medicare, Social Security, Highway).

A simple majority of the commission members (including at a minimum three legislators from each party) would need to agree to advance a final proposal. Legislators from both chambers could then vote on the package, without consideration of amendments or points of order, and under expedited procedures that limit congressional debate time.

The Fiscal Commission Act of 2023 is a promising vehicle for highlighting the policy choices necessary to sustainably stabilize the debt. Its work will be critical to advancing greater public and member understanding of the challenge before us. For it to succeed in advancing reforms in Congress that would avert a fiscal crisis will require strong bipartisan majorities.

I’ve been arguing that Congress should establish a fiscal commission that is modeled after the successful Base Realignment and Closure (BRAC) commission. I believe that Congress will need to rely more heavily on outside experts and on a fast‐track mechanism that allows for silent approval (instead of an affirmative vote) to reform old‐age entitlements. I’ve also advocated for Congress to advance this model as a fail‐safe mechanism that would trigger if Congress didn’t agree to reforms.

Instead, the Fiscal Commission Act is modeled after the Greenspan commission which helped Congress avert automatic Social Security cuts when the trust fund was about to be depleted in 1983. I worry that without such a similarly hard deadline that threatens severe consequences if Congress fails to act, the Fiscal Commission Act may not have enough teeth to persuade majorities in both chambers to agree to politically difficult reforms before we approach the current trust fund exhaustion dates (2031 for Medicare and 2033 for Social Security).

Delaying reforms will bake in higher debt and taxes and reduce options available to Congress for restraining spending. That would come at a high cost to US workers and taxpayers who will suffer lower incomes and fewer opportunities as a result.