Chris Edwards

The federal government’s debt is rising to dangerous and unprecedented heights. Compared to the size of the economy, the debt will soon reach levels never seen in our nation’s history.

Congress should change course and cut spending to reduce debt. Over the years, Congress has occasionally implemented new budget rules, but no effective restraint on spending or debt has yet been enacted. Congress is currently projected to add an astounding $19 trillion more in debt over the coming decade. This is fiscal insanity.

There is hope, however. A solution presents itself when we compare out‐of‐control federal debt to stable and legally constrained state debt. Federal debt is eight times larger than the combined debt of all state and local governments. Why is that, given that all elected officials have the same incentives to borrow and spend? The answer is that the states have extensive constitutional, statutory, and economic restrictions on deficits, debt, and spending that steer them toward fiscal responsibility.

That suggests that a way to tackle government debt is to devolve a large part of federal spending to the states, allowing them to fund it themselves. It is better to fund most government spending at the state level because state debt is restricted.

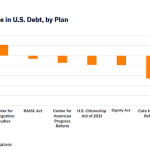

My new Cato study argues that to avert a debt crisis we should take advantage of America’s federal structure and decentralize most government spending. Such a reform would not only tackle debt but also strengthen democratic accountability and improve government efficiency and performance. The study includes a specific plan to stabilize federal debt as a share of the economy.

See “Reviving Federalism to Tackle the Government Debt Crisis.”