One of the most crucial decisions when managing your investments is selecting the right investment manager for your portfolio. An investment manager is pivotal in ensuring financial success and achieving long-term goals.

With abundant options available, it’s essential to conduct thorough research and consider various factors before entrusting someone responsible for managing your hard-earned money.

The Importance of an Investment Manager

In the intricate landscape of investment management, the role of an investment manager holds immense significance. These financial professionals are akin to navigators, steering your investment ship through the tumultuous seas of the market.

The expertise they bring to the table can spell the difference between financial success and disappointment. Let’s examine why having the right investment manager for your portfolio matters.

Expertise and Insight

The world of finance is complex, dynamic, and often unpredictable. Investment managers have dedicated their careers to understanding this world intimately. They possess a deep-seated knowledge of financial markets, economic trends, and the intricate interplay of various assets. This expertise allows them to make informed decisions that maximize returns while minimizing risks.

Time and Dedication

Managing investments isn’t just about making a few decisions and letting them run their course. It requires continuous monitoring, analysis, and timely adjustments. This can be a daunting task for the average individual alongside their daily responsibilities. On the other hand, investment managers are committed to dedicating their time to researching opportunities, analyzing data, and adapting strategies to changing market conditions.

Tailored Strategies

Every investor’s financial situation and aspirations are unique. An adept investment manager recognizes this individuality and crafts strategies tailored to your needs. Whether aiming for retirement, saving for a major purchase, or seeking wealth preservation, a skilled investment manager can devise a roadmap that aligns your investments with your personal goals.

Emotional Detachment

Human emotions often play havoc with investment decisions. When markets fluctuate, fear and greed can lead individuals to make impulsive choices that may not be in their best interests. Investment managers, guided by data and analysis rather than emotions, provide a buffer against such impulsive behavior. Their objective approach helps maintain a steady course through market turbulence.

Risk Management

Investing inherently involves risk, but effective risk management can mitigate its impact. Investment managers excel in assessing risk, diversifying portfolios, and implementing strategies that cushion against potential downturns. Their skillful risk management safeguards your investments and preserves your peace of mind.

Access to Opportunities

The investment landscape offers many opportunities, from traditional stocks and bonds to alternative investments like real estate or private equity. Investment managers have the expertise to identify and capitalize on these opportunities, potentially enhancing your portfolio’s returns. Their ability to navigate these diverse options provides a broader spectrum of investment avenues.

Continuous Learning

Financial markets evolve, regulations change, and economic dynamics shift. Investment managers are dedicated to staying abreast of these developments. Their commitment to continuous learning ensures that your portfolio is managed with the latest insights and strategies, adapting to the ever-changing financial landscape.

Long-Term Vision

Investment success is often measured over the long term. Investment managers are equipped with the patience and vision required for long-term wealth creation. They understand that market fluctuations are part of the journey and are focused on the overarching goals, not just short-term gains.

Coordination of Complexities

For high-net-worth individuals, portfolios can be intricate and diverse, encompassing various asset classes and financial instruments. Coordinating these complexities requires a deep understanding of finance. Investment managers possess the understanding to ensure that all portfolio components work harmoniously to achieve your financial objectives.

Peace of Mind

Ultimately, the role of an investment manager extends beyond numbers and graphs. It’s about offering you peace of mind. Knowing that a knowledgeable professional diligently manages your investments allows you to focus on other aspects of your life confidently, knowing that your financial well-being is in capable hands.

Key Factors to Consider

Experience and Track Record

When evaluating potential investment managers, their experience and track record should be at your list. Look for managers who have successfully navigated different market cycles and consistently performed over time. Their ability to adapt to changing economic conditions is a testament to their skills and expertise.

Investment Philosophy and Strategy

Understanding the investment philosophy and strategy of a manager is crucial. Some managers prefer a conservative approach, focusing on stability and long-term growth, while others might be more aggressive, seeking higher returns through riskier investments. These are a gamble and may rise and boomerang back and end up worth less than they would have initially. Aligning the manager’s strategy with your risk tolerance and financial goals is paramount.

Communication and Transparency

Effective communication is the cornerstone of a successful relationship with your investment manager. They should be willing to explain their investment decisions, strategy changes, and portfolio performance clearly and understandably. Transparency in fees, charges, and potential conflicts of interest is also essential for building trust.

Fee Structure

Different investment managers have varying fee structures. These can include management fees, performance-based fees, and other charges. Understanding the fee arrangement upfront is important to ensure it aligns with the value you expect to receive and your overall financial plan.

Diversification Approach

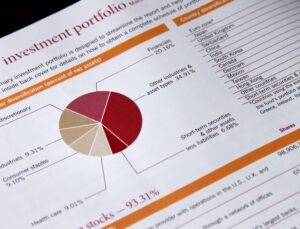

A sound investment strategy involves diversification across asset classes, industries, and geographical regions. Inquire about how the investment manager approaches diversification and risk management. A manager who emphasizes diversification can help mitigate the impact of market volatility on your portfolio.

Client References and Reviews

Don’t hesitate to ask for client references or look for reviews online. Hearing from current or past clients can provide valuable insights into the investment manager’s performance, communication skills, and overall client satisfaction.

Credentials and Qualifications

Look for investment managers with relevant credentials and qualifications such as Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), or similar designations. These certifications often require rigorous education and ongoing professional development, indicating a commitment to excellence.

Customization and Personalization

Each investor’s financial situation and goals are unique. A good investment manager should take the time to understand your specific needs and create a customized investment strategy that aligns with your objectives.

Technology and Tools

Technology plays a vital role in investment management in today’s digital age. An investment manager with advanced tools and technology for analysis, tracking, and reporting can provide more accurate and timely information about your portfolio’s performance.

Risk Management Approach

A skilled investment manager should have a well-defined approach to managing risk. Inquire about how they handle market downturns, unexpected events, and changes in economic conditions. A solid risk management strategy can help protect your portfolio during turbulent times.

Conclusion

Selecting the right investment manager for your portfolio is a decision that requires careful consideration. Take the time to research and evaluate potential candidates based on their experience, investment philosophy, communication skills, fees, and more.

Remember that your investment manager should be a partner in your financial journey, working to achieve your long-term goals while navigating the complexities of the financial markets. By following these guidelines and asking the right questions, you can make an informed choice that sets your portfolio on a path to success.

Read more:

Selecting the Right Investment Manager for Your Portfolio