I scooped up two profitable trades Tuesday morning — 30 minutes into the trading session.

You can see every trade I take here at profitly.com

While an extra $500+ in daily profits isn’t going to change my life…

…I know it can do a lot for people hurting in this economy.

That’s why I want to go in depth with you today. And explain to you what morning panic setups are all about.

If you’re wondering what strategies are working in this market, and how to apply them to make consistent profits like I have this year … then you’ll want to $tudy these two trades.

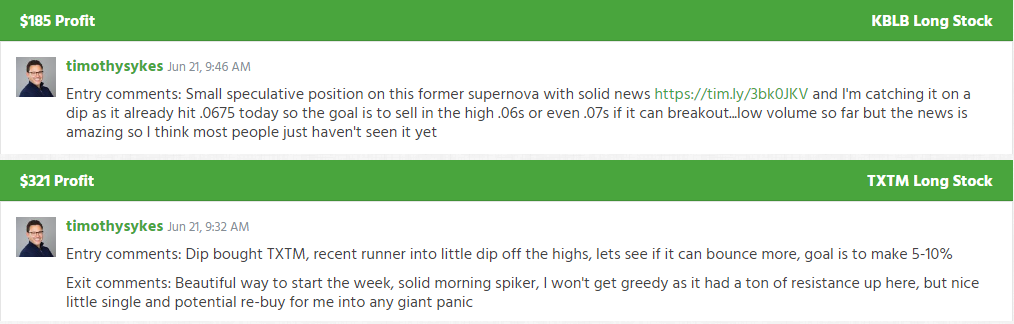

ProText Pharma Inc (OTC: TXTM)

Back on the 13th of June, news hit the wire that the Republic of South Africa Medical Marijuana Dispenseries Acquisitions LLC completed its acquisition of ProText Mobility (AKA ProText Pharma).

This was what’s known as a reverse merger, where a smaller company acquired a larger one.

Except this wasn’t anything new.

Back in August, there had been speculation about this reverse merger. It never materialized back then.

This time, the reverse merger actually went through, and promoters felt entirely validated, sending shares soaring over the next couple of weeks.

That led to heavy buying pressure, pushing shares up as much as 855% on ridiculous volume.

For me, this leads to some great opportunities for the morning panic dip buy.

Here’s the framework I used.

Out of the gate, shares sold off hard on volume that was nearly 2x what it was on Friday’s open.

That pushed the price lower, getting it close enough to the prior close support level that I felt ok stepping into the trade.

Now, if I wanted a bit more security, I could’ve waited for that green reversal candle which came with higher volume than the candle before.

Once the stock bounced back, I simply waited until the momentum died out and then took my profits.

This type of trade setup takes practice. I want to buy only when I expect price to be capitulating and making a bottom, not just taking a stab at where the lows might be.

And as I noted earlier, a safer way to do this is to wait for that reversal to show itself.

Where would my stop be on a trade like this?

Initially, I would set it at or below the low. However, if the stock simply stopped where it was and didn’t bother to bounce, I’d take the trade off quickly and keep my losses as small as possible.

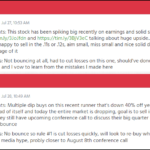

Now, let’s look at KBLB.

Kraig Biocraft Lab Inc (OTC: KBLB)

Around 7:00 a.m. Eastern, news hit that KBLB subcontractor pilot production had achieved the required Spider Silk Production levels for the Spydasilk apparel launch.

While it certainly didn’t garner attention in premarket, I really felt like the market underappreciated how bullish this information was for this stock.

Now, this stock has a large float with 771 million shares that trade. However, the volume is typically only a few million per day.

What caught my interest with this stock was its daily candlestick on Friday.

This stock was a former Supernova, so I saw the dip as a potential panic play.

You can see in the chart below how that $0.05 level had been long-term support.

Taken together, these gave me the idea for a trade setup.

Here’s how I the executed the play.

First, I want to point out the lighter volume.

Notice how there are minutes that go by without any trades. This can and does happen with OTC and other thinly traded stocks.

However, that doesn’t mean I can’t use the same price action analysis to define the trade.

Now, this stock already hit a high out of the gate, so I was buying into the pullback.

Plus, I expected shares to garner more interest as folks picked up on the story.

For me, this was a simple buy the dip and sell into strength strategy.

I had already let the stock sell off and begin its rebound. With the low volume and an already wide range for the day, I wanted to see shares run back towards the high of the day, if not a bit past.

All it took was a few more minutes and I had my exit.

Now, I know stocks with low volume like these can scare away some traders.

When I first started learning how to trade these stocks, I kept my position sizes very small.

Instead of trying to make money on every trade, I focused on watching the price action and refining my setups.

That’s largely how I came up with my Supernova pattern.

It was the one setup that caught my attention and continued to repeat over and over.

And that’s all it takes is just one pattern.

That’s why I make it super easy to sign up and learn about Supernovas.

Traders from all over the world can spot this pattern in any market on any chart.

Click here to learn more about my Supernova Pattern.

—Tim

The post Two Winners in Less Than 30 Minutes – $TXTM & $KBLB appeared first on Timothy Sykes.