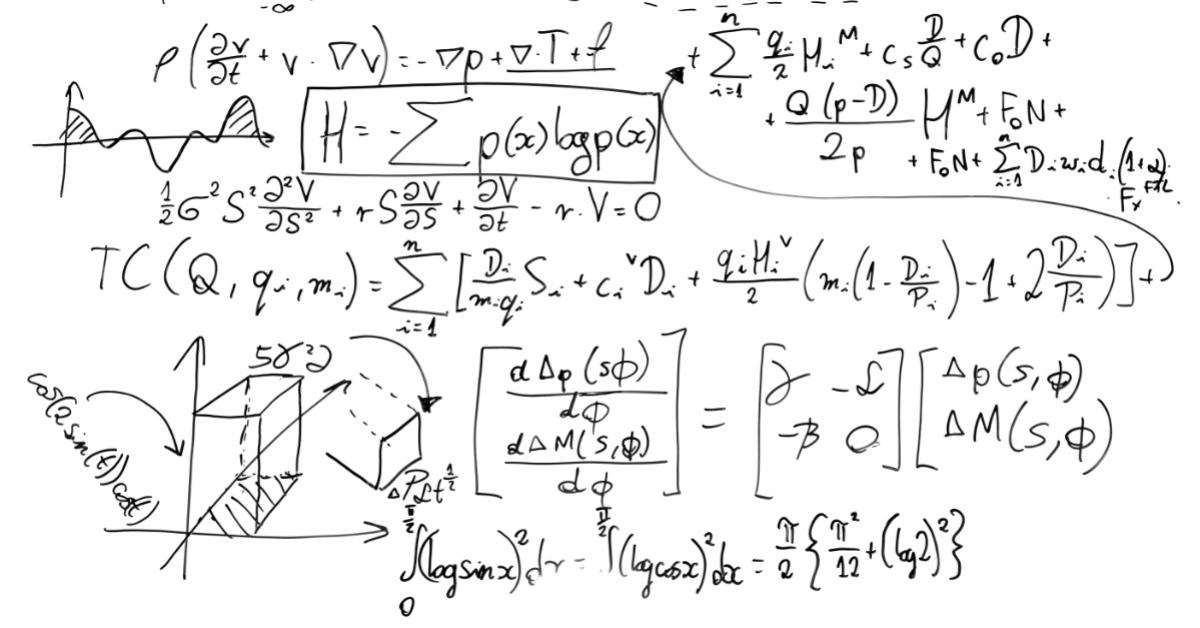

The mainstream of economics today makes use of mathematical techniques so extensively that to professionals and laymen alike, the discipline resembles a branch of applied mathematics.

Consequently, the Austrian school (for whom math is of little importance in the study of economics) is dismissed and derided by much of the mainstream profession. This attitude goes so far as to regard it as impossible for the Austrian school to produce any valid research. And it is commonly thought that any correct prognostication by the Austrians is arrived at by sheer luck. This last point is particularly ironic given the Austrians were the only school to correctly call the 2007–08 financial crisis.

In this article I will spend little time discussing the intricacies of either Austrian or mainstream methodology, and instead assume that the reader already possesses this knowledge. If not, the reader should consult the resources provided by the Mises institute, particularly Hans Hermann Hoppe’s work Economic Science and the Austrian Method. I can recommend it strongly as one of the books from which I have learnt the most information per page out of every book I have read.

Instead, atypically for an Austrian, I will apply some empiricism to prove that Austrian economics should have a place at the table in modern, mainstream economic discourse by its own premises and epistemology. Call it reverse engineering.

Mainstream economists are proud of the methodological changes that have occurred over the course of the discipline’s history. They view earlier stages of economics, characterized by deductive logical reasoning, as a “dark age” of unscientific and amateurish inquiry. They are thankful the discipline has moved on to empirical and quantitative methods and are scathing about the Austrian school’s persistence with the old techniques of analysis. In practical terms this manifests as dismissing the Austrians’ research and relegating them to the fringes of the profession.

One problem with this reasoning is that the traditional method in economics was dominant certainly through the early twentieth century, and arguably up to World War II. Much of the body of modern economics is composed of insights from this period and earlier. Based on what they say about the Austrians, the mainstream should pretend that they don’t know any of these ideas and attempt to reforge the entire premodern oeuvre using modern quantitative, statistical, and empirical methods.

They don’t, predictably, because their results would be chaotic, self-contradictory, and incomprehensible. They would have to control for endless variables and ignore activity that can’t magically cease in the real world. There would subsequently be endless politically motivated debates between partisans about the ramifications of how the models and/or experiments were constructed. Most of the knowledge built up by the discipline would be invalidated. Here is a serious question: can anyone name one new idea from the past thirty years that is agreed upon by all within the economics mainstream, and is proven unfailingly by the historical record?

None of this is confessed, and this issue of the epistemology of previous discoveries is just quietly ignored. The (unspoken) reasoning is that why would one reexamine discoveries already understood and acknowledged as true. But that’s exactly the point of this article; these truths were discovered using the traditional logical-deductive methodology.

Take for example the concept of opportunity cost. Because human beings are incapable of being in two places at once, and because resources are scarce, not unlimited, people are incapable of fulfilling all their wants at the same time. Every action thus incurs the opportunity cost of having to forego taking the second most desirable action, the one a person would have otherwise chosen, but is now incapable of pursuing.

This is a general principle that holds true a priori across all different types of real-world scenarios. It is logically impossible to contradict within the human condition. We could stipulate an example where one only has three dollars to spend, and one’s first choice is to buy a coffee (cost $2) and one’s second choice is to buy a slice of cake (cost $1.50). In this case the opportunity cost of buying a coffee is foregoing a slice of cake. Equally we could substitute any items at any price points, and the concept of opportunity cost would remain true. Opportunity cost was developed by the Austrian school (Carl Menger and Friedrich von Wieser) using the traditional logical-deductive method. It is still accepted today within the body of mainstream economic thought.

Another interesting point to note is that Wall Street seems to understand Austrian business cycle theory. The year 2022 has been bad for the US stock market. To summarize: in 2020 and 2021 the Fed printed and distributed enormous amounts of cash, and this caused severe price inflation. To combat inflation, the Fed has raised interest rates (and it seems like they will raise rates further) and the rate increases (and expectation of further raises) make investors bearish, as many companies are ridiculously leveraged, and higher interest rates will render them insolvent. The easy money created malinvestment and price inflation, and the only way to solve price inflation is by raising rates, which bursts the malinvestment bubble and creates a recession. This relates to the Wall Street maxim: “Don’t fight the Fed.”

I bring this up to note that the views and actions of people who have serious money at stake corresponds to Austrian theory. Austrian thought is not insubstantial and disconnected from reality, rather it has many insights applicable to the real world, as it is based on the empirically indisputable axiom of human action and its logical derivations.

I am not an antimath totalitarian. While academic economics shouldn’t use any math, there is evidently an important role for mathematical techniques in the business disciplines. This can be illustrated best by the example of economic calculation. As a general principle of academic economics, this phenomenon is best described in verbal terms, and was discerned by Mises using logical-deductive reasoning. Of course, the corollary of the universal academic observation of economic calculation is that nonacademic, individual businessmen have to actually make economic calculations, the practice of which obviously involves a mathematical component.

Though “pure,” or academic, economics doesn’t involve any math, there is clearly overlap between economics and business disciplines. It is a good idea for businessmen to learn some economic theory, and it is a good idea for economists to learn some of the techniques of modern business (though in my view mathematical techniques are also slightly overused in this domain). There are opportunities for interdisciplinary study, consultation, and professional diversification for academic economists who engage with these techniques, and I tend to favor undergraduate or independent study being reasonably broad based.

While this academic climate would be ideal, unfortunately the intellectual world we live in is warped by mainstream academic economics neglecting theory, and frequently engaging in snobbishness against the business disciplines, absurdly viewing them as inferior because they use less complicated math.

The reason why mainstream economics uses ever more complicated math is because it has chosen the wrong analytical path and struggles to arrive at solid insight. In a curious parallel to the phrase “that wasn’t real socialism,” they continue to force the issue, whereas the math used by business disciplines fits them far better, and its use is explainable under the profit-loss/economic calculation rubric of economic theory.

To retreat somewhat from the normative thinking of the previous few paragraphs, we could debate what constitutes the best methodology to study economics, but all parties should agree the Austrian/ traditional method is valid. This is because many ideas accepted today in mainstream economics were arrived at by this approach, and contemporary Austrian school research (especially concerning business cycles) has clear relevance in the real world. Thus, by their own empirical-historical epistemology, mainstream schools of thought should grant the Austrians a place at the table of contemporary academic discussion.